The Psychology of an Evolving Market

Before getting into our housing market predictions for the year, it’s important to understand market mentality.

People like predictability and clear narratives. So to make sense of perceived chaos, we tend to use our own experiences to craft explanations that are typically incomplete. This can be a problem when everyone has experienced a fraction of what’s out there but draws definitive conclusions anyway.

While some may preach that the market is peachy and will go on like that forever, others warn of crashes, doom and gloom. The truth is somewhere in the middle.

Beware of any extremist headlines one way or the other. The more dramatic they are, the more likely people are to click for more, and that’s the name of the game. It’s called clickbait, and it’s all over the internet.

BOTTOM LINE: Don’t follow people down emotionally charged rabbit holes. Recognize the emotion for what it is, set it aside, and get the facts. The media often provides information without context.

Historical and Generational Trends

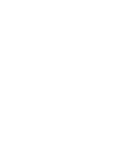

From 1986-2008, US homeowners lived in their homes an average of six years. From 2008-2017, the average time increased to nine years. The difference indicates pent-up seller demand, people who would have sold but waited for various reasons.

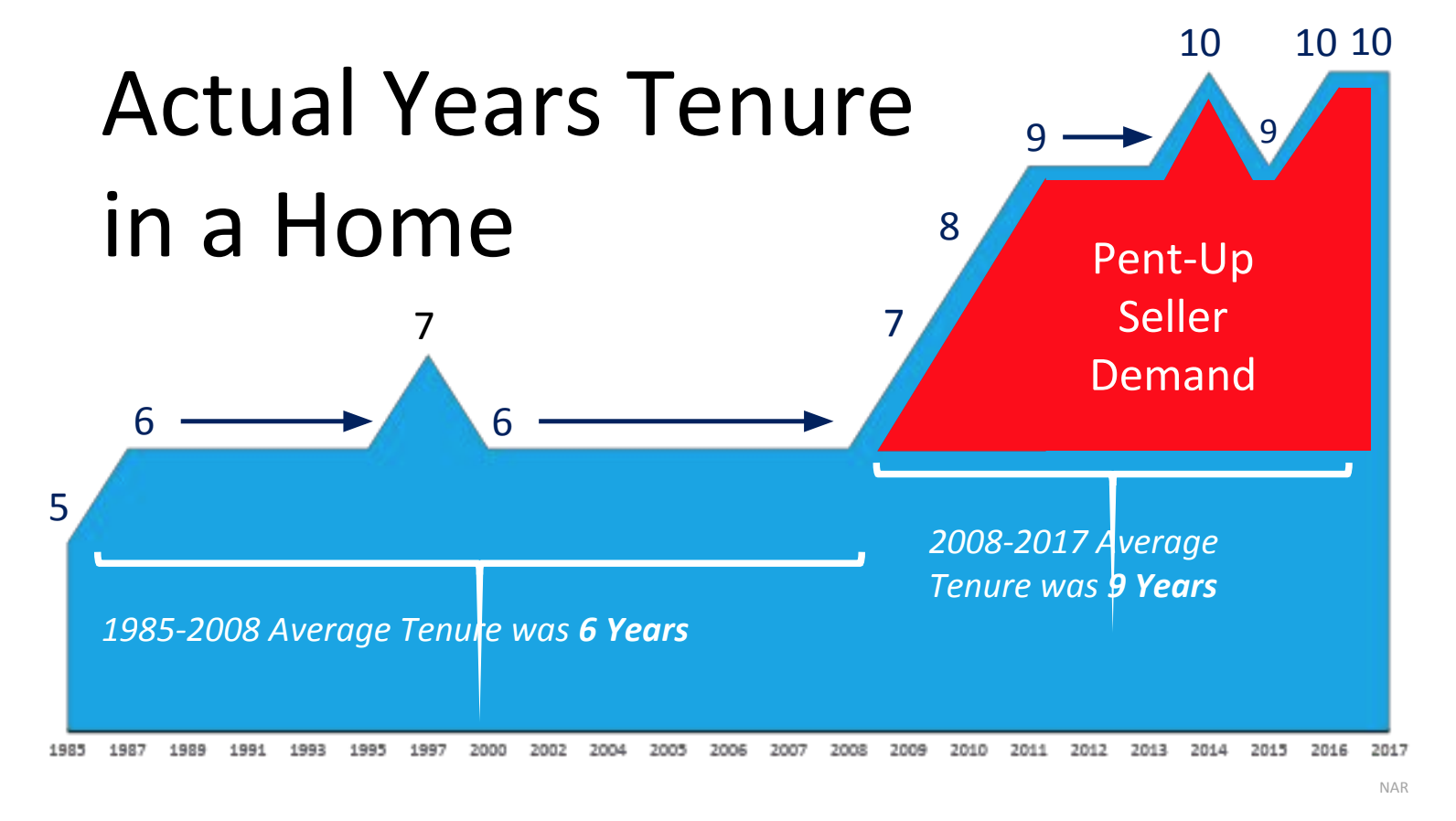

After a multiyear runup, existing home sales from 2017-2019 saw a modest cooling down period followed by a bit of a rebound in late 2019.

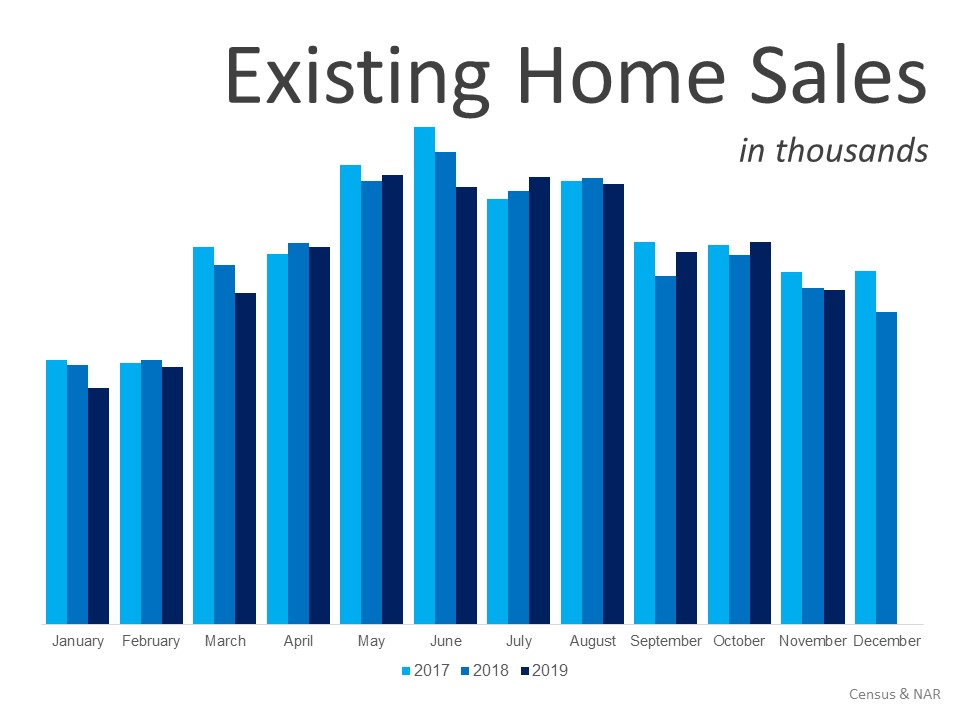

Meanwhile, new home sales witnessed strong year-over-year gains from 2017-2019.

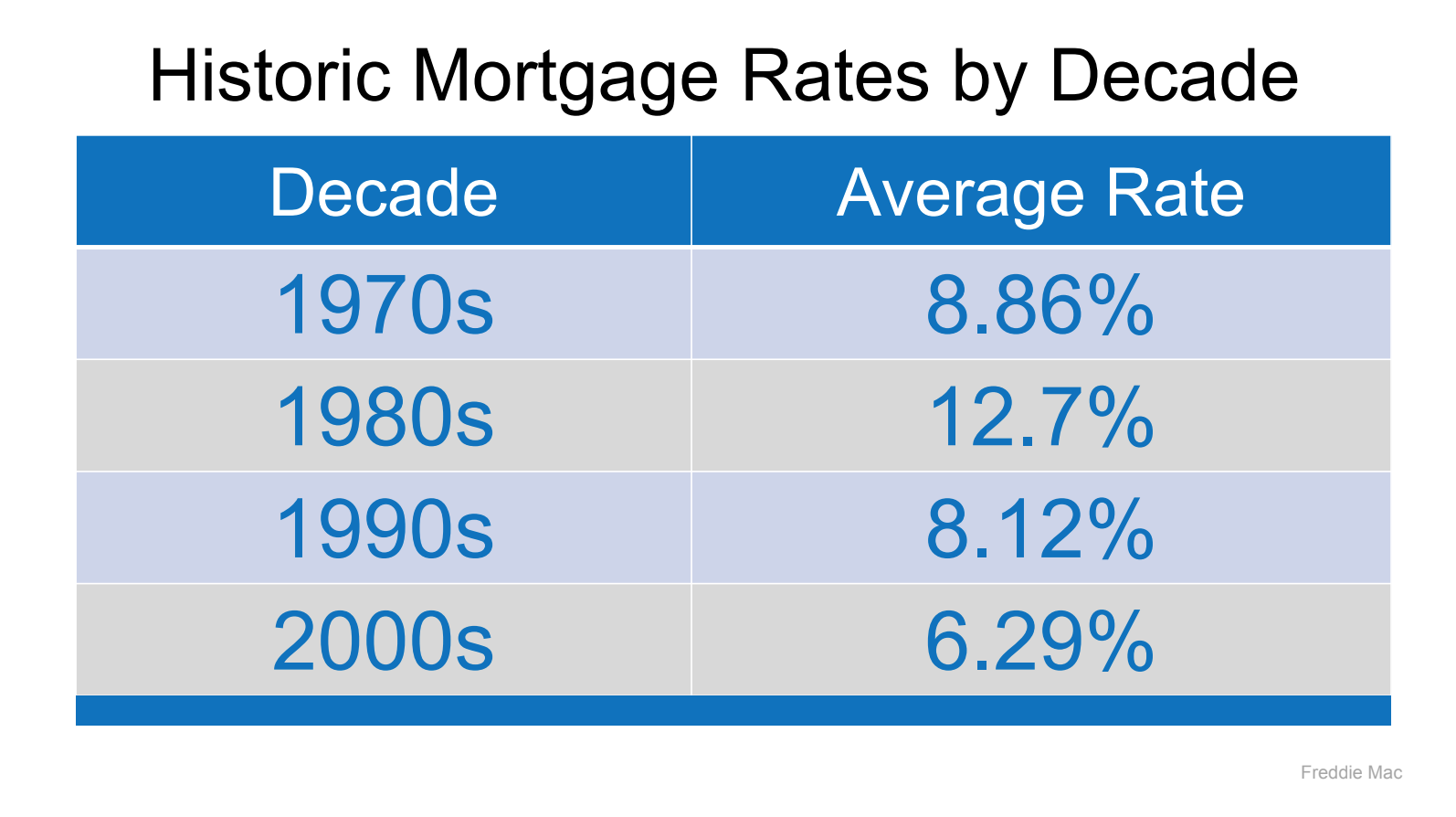

Let's look at historic mortgage rates. Millennials, their entire lives, have only known rates in the 3.5-4% range. But consider the average rates for the prior four decades.

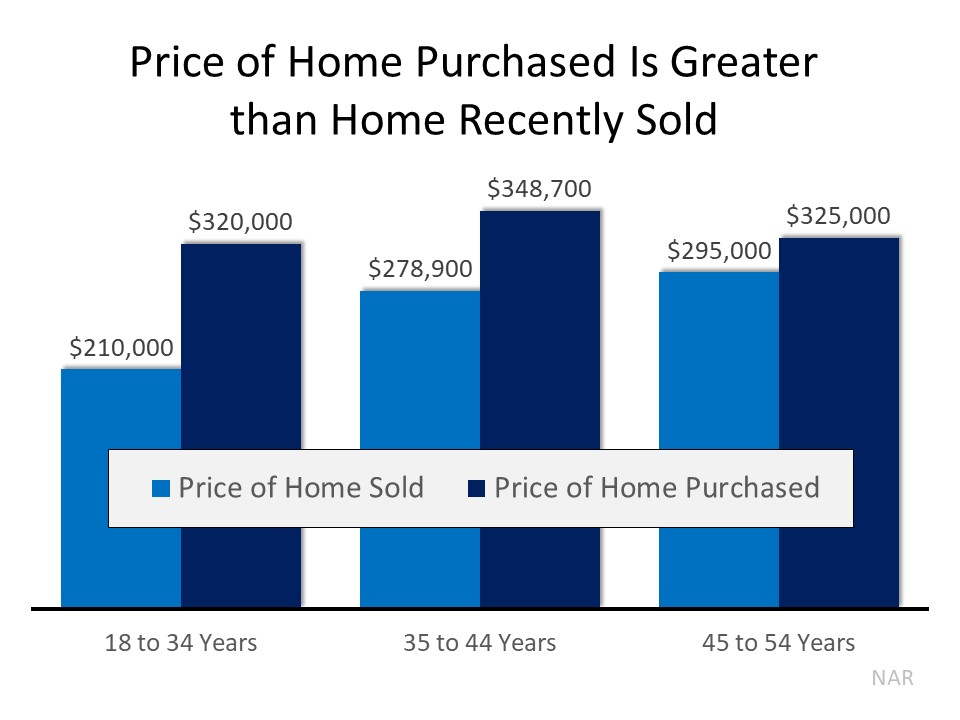

Millennials now make up the largest share of homebuyers at 37%, with the second-largest group being Gen X-ers at 24%. Of all homebuying age groups, 33% are first-time buyers, 12% buy multi-generational homes and 88% finance their purchase to some degree, according to the National Association of Realtors.

There’s also a noteworthy trend among Millennials dubbed Hipsturbia, where young people move out of the city and into smaller, less expensive suburban towns that still offer vibrant, walkable communities, restaurants, retail and recreation. This is a trend that bodes well for the Reno-Tahoe-Carson region.

BOTTOM LINE: In 2019, the market normalized after a heated run but still has many supports. Pent-up seller demand, Millennials entering the market and a shortage of affordable inventory should continue to support housing prices in the local real estate market throughout 2020.

National Real Estate Trends

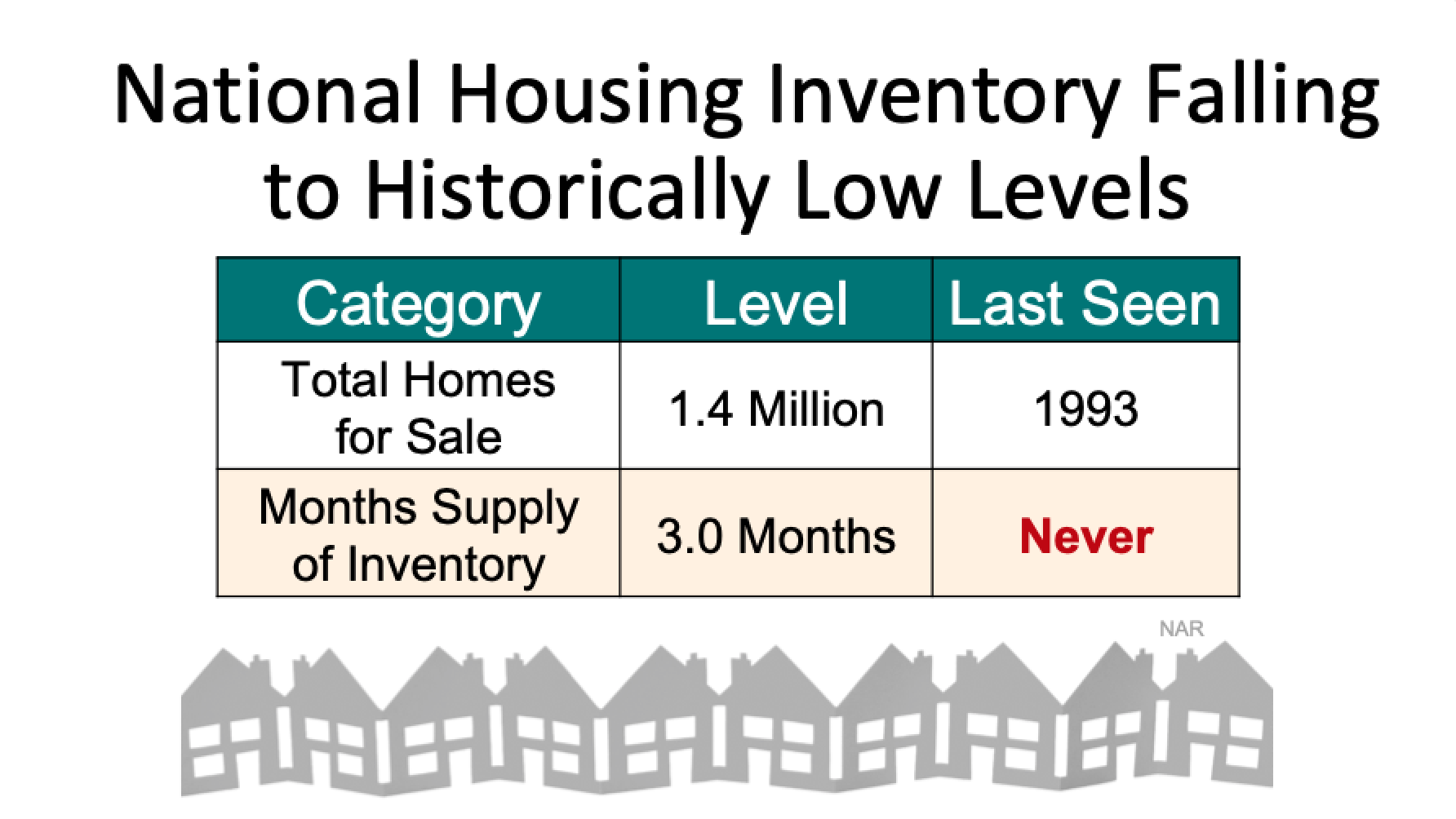

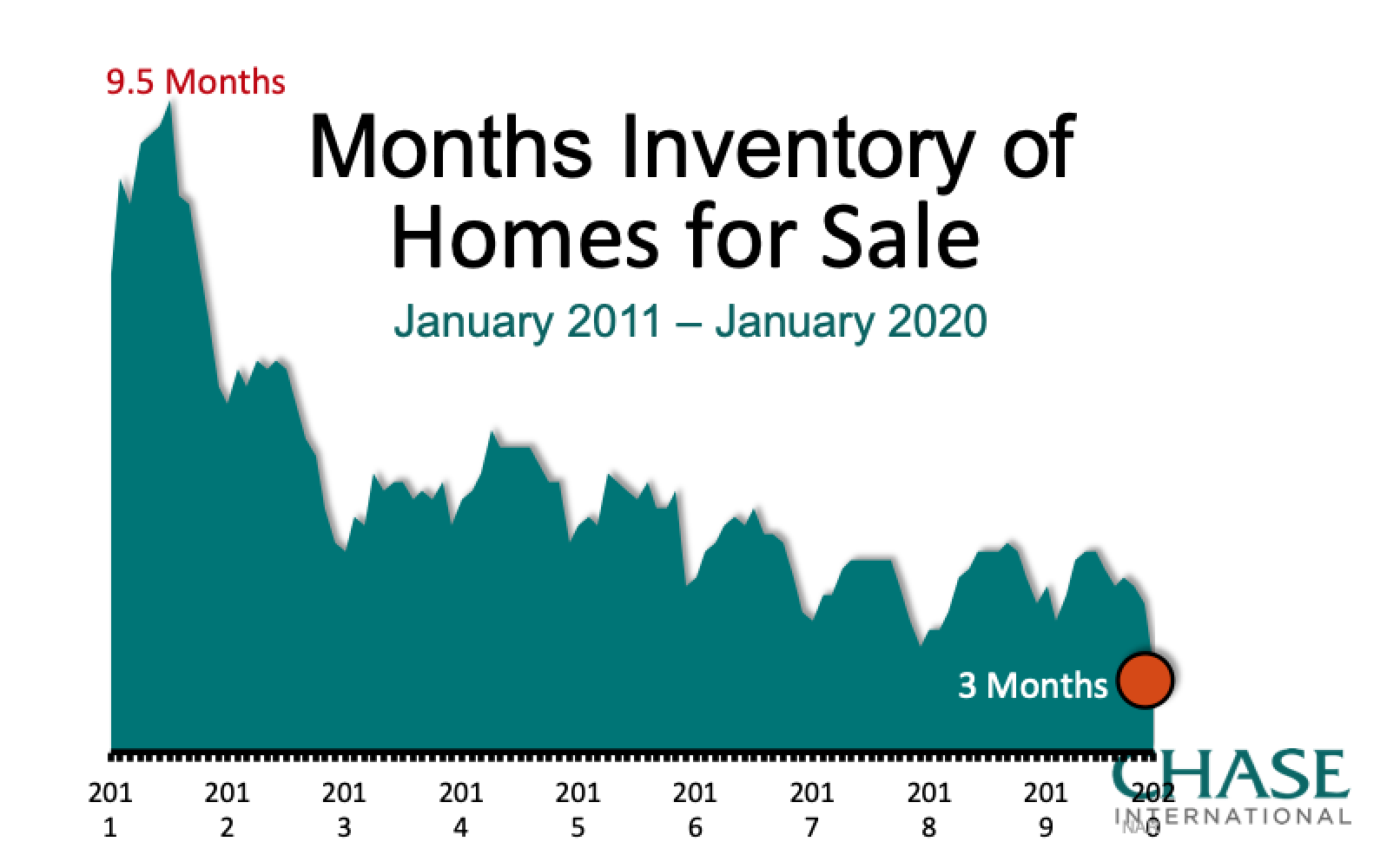

The biggest issue in the national housing market in 2020 continues to be the shortage of inventory.

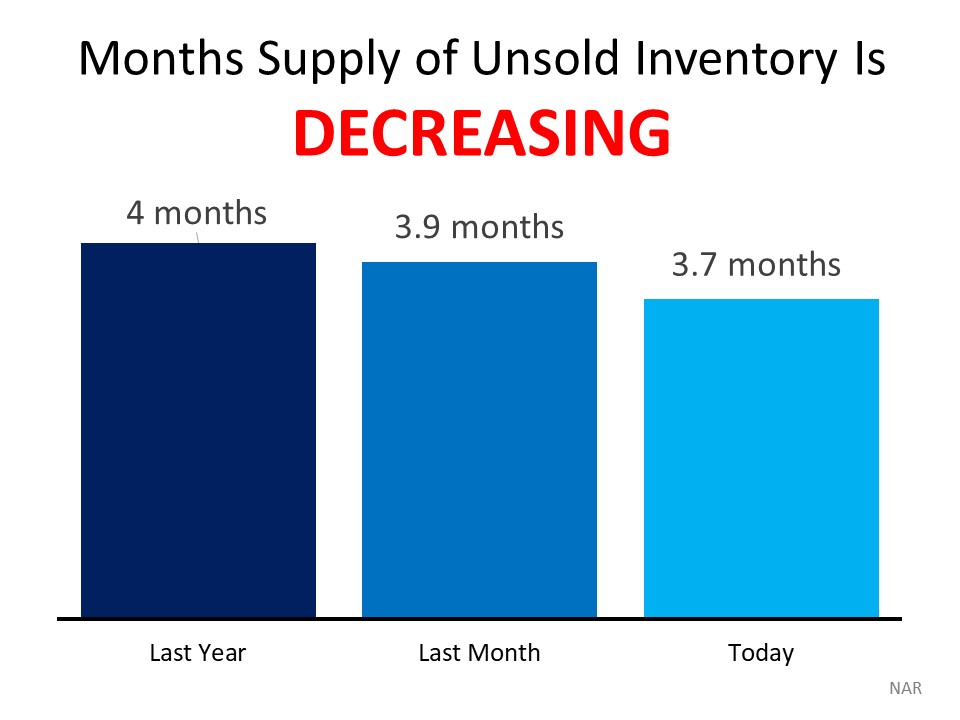

If we look at months’ supply of inventory nationally, it’s down from last year, and it’s down month-over-month. So the supply of inventory is definitely decreasing.

At the end of 2019, we were down to 3.7 months nationally, and Realtor.com is projecting that might continue to fall.

Realtor.com noted that in 2020, they expect inventory to struggle to grow, acknowledging that it might even reach historic low levels.

As of the end of January 2020, we've already gone lower:

Months’ supply means that if no more new inventory came on the market, at today’s rate of sale, how long would it take for every property to sell out?

Historically in our region, anything under six months is considered favorable to sellers, while 6-12 months is balanced. Over 12 months of inventory is a buyer’s market.

We are far below these levels in the Reno-Tahoe-Carson region, as this chart illustrates:

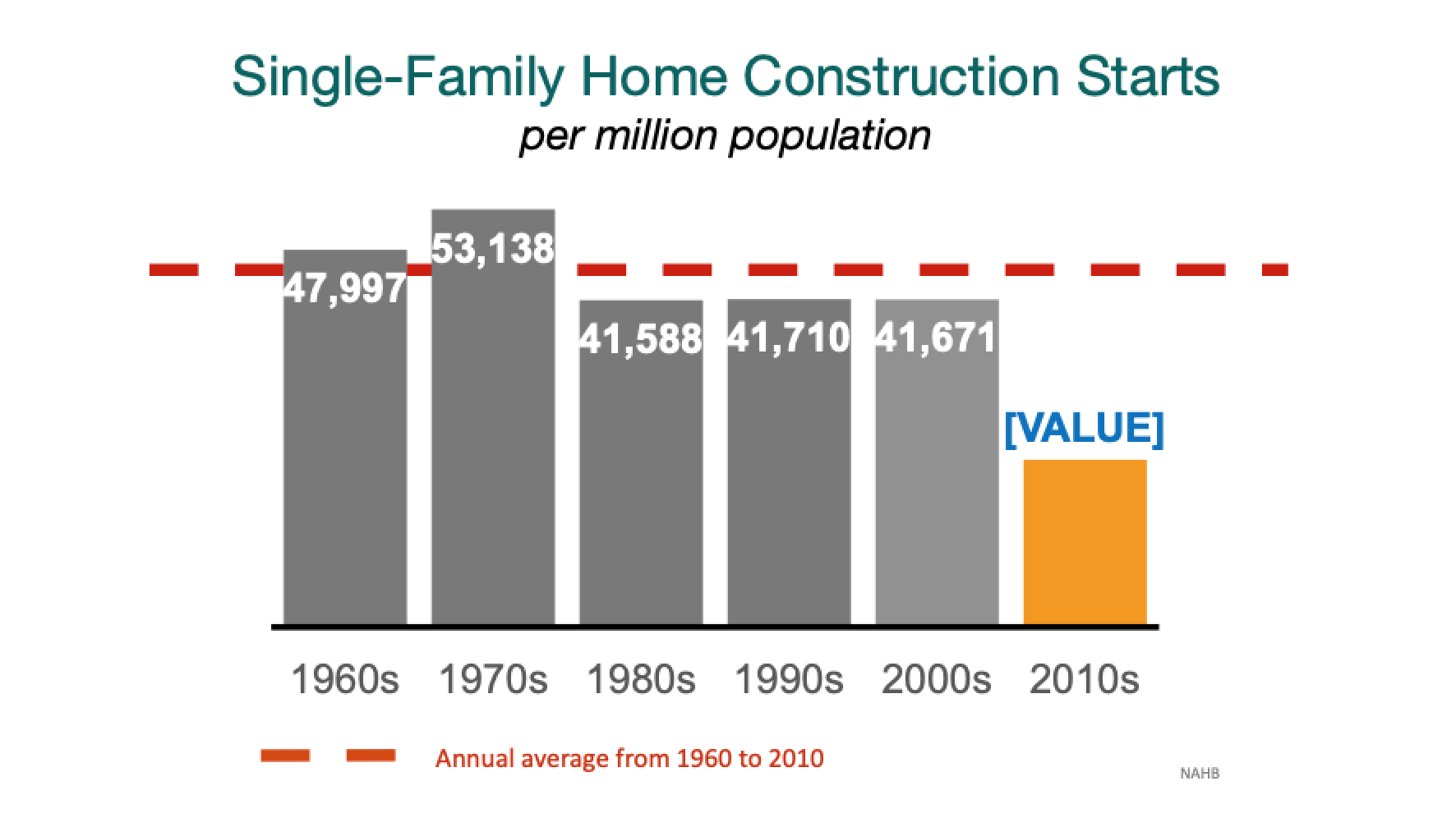

Single-family new home construction has been below average levels for decades, exacerbating the supply problem:

BOTTOM LINE: Affordable inventory is the constraining factor, and new home building is not keeping up with demand. Expect tight inventory to be a continuing theme throughout 2020.

Mortgage Delinquencies

The Mortgage Banker's Association (MBA) reports that mortgage delinquencies on loans of all types have fallen to their lowest level in 40 years.

The delinquency rate was down 20 basis points from the third quarter of 2019 and 29 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter remained unchanged at 0.21 percent.

According to Marina Walsh, MBA's Vice President of Industry Analysis:

"The mortgage delinquency rate in the final three months of 2019 fell to its lowest level since the current survey series began in 1979. Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment at historic lows, it's no surprise to see so many households paying their mortgage on time."

BOTTOM LINE: Distressed property sales should continue to be a very small segment of the market throughout 2020.

Mortgage Rate Predictions for 2020

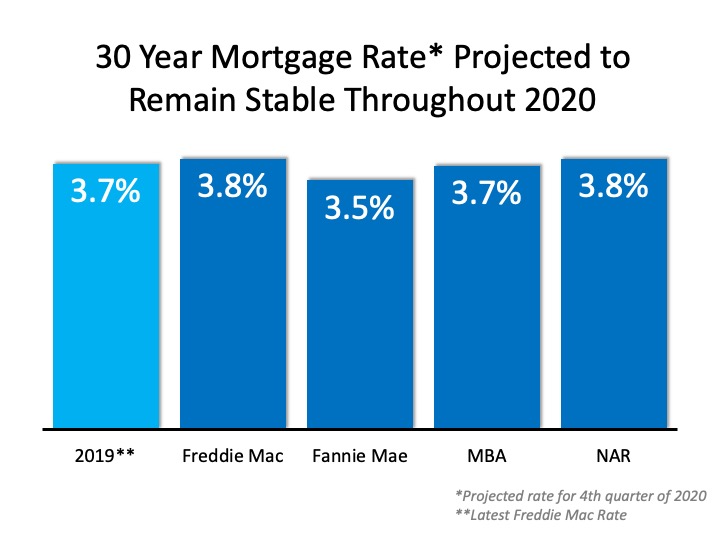

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020:

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Freddie Mac expects mortgage rates to remain low over the next two years, averaging 3.8% in 2020 and 2021. Some experts think they might even go below that, under 3.5%.

Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors also agree that rates will be between 3.5 and 3.8% this year.

BOTTOM LINE: Interest rates and mortgage rates are projected to stay low for the next two years, and that should continue to drive demand in the market.

2020 Home Price Predictions

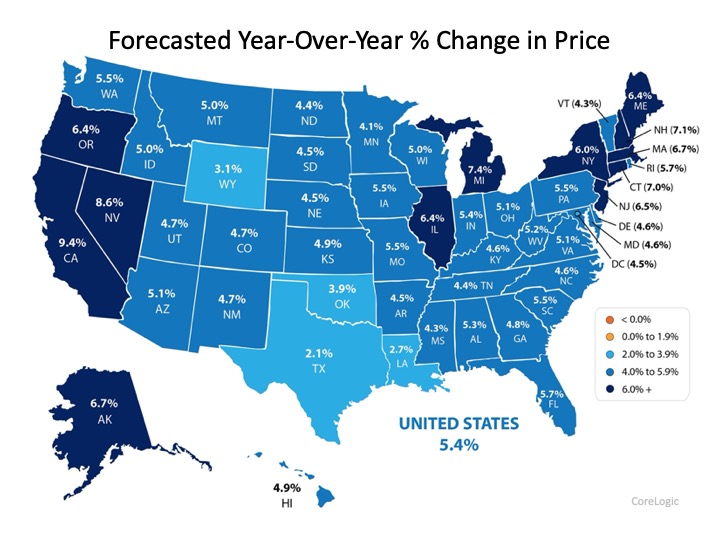

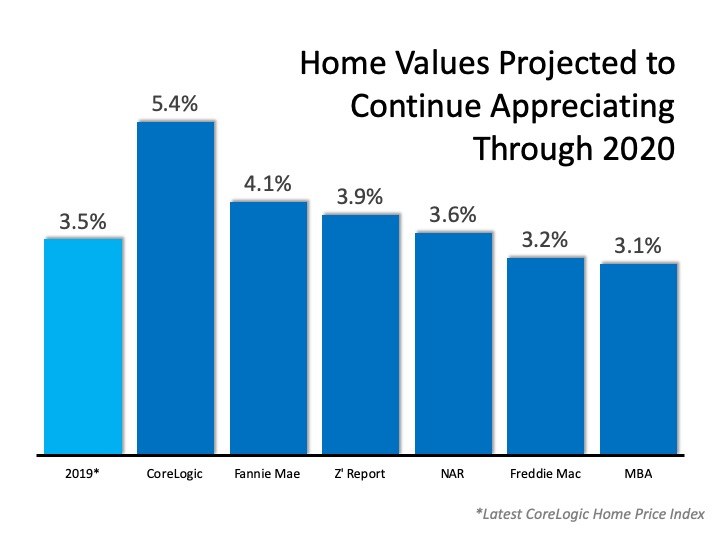

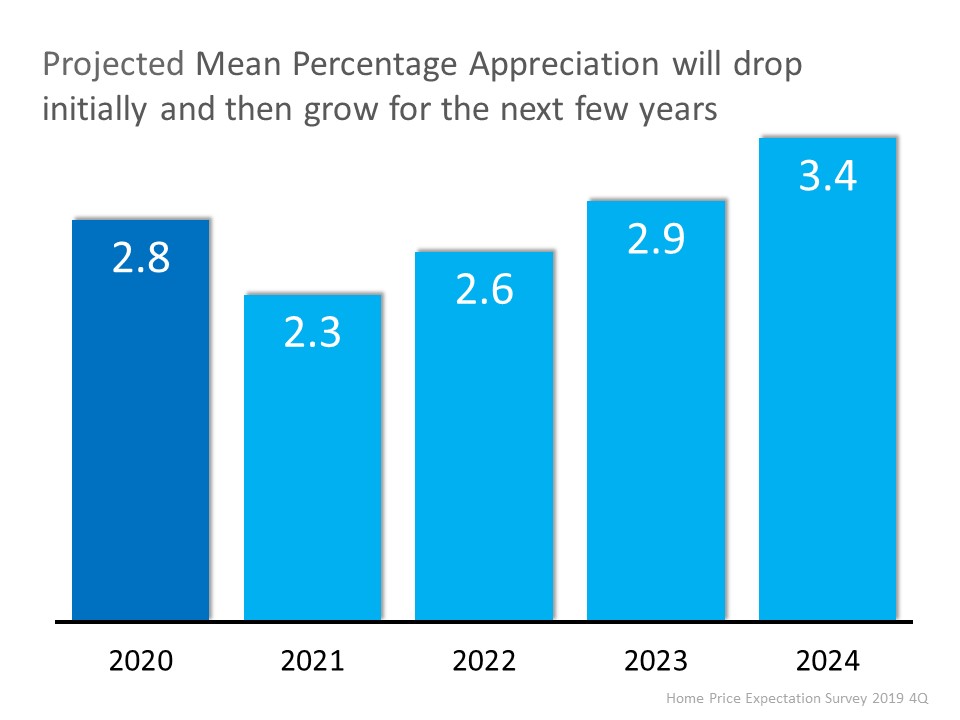

Questions continue to rise around where home prices will head in 2020. The latest forecast from CoreLogic shows continued appreciation at 5.4% nationwide over the next year, with an 8.6% price increase predicted for Nevada:

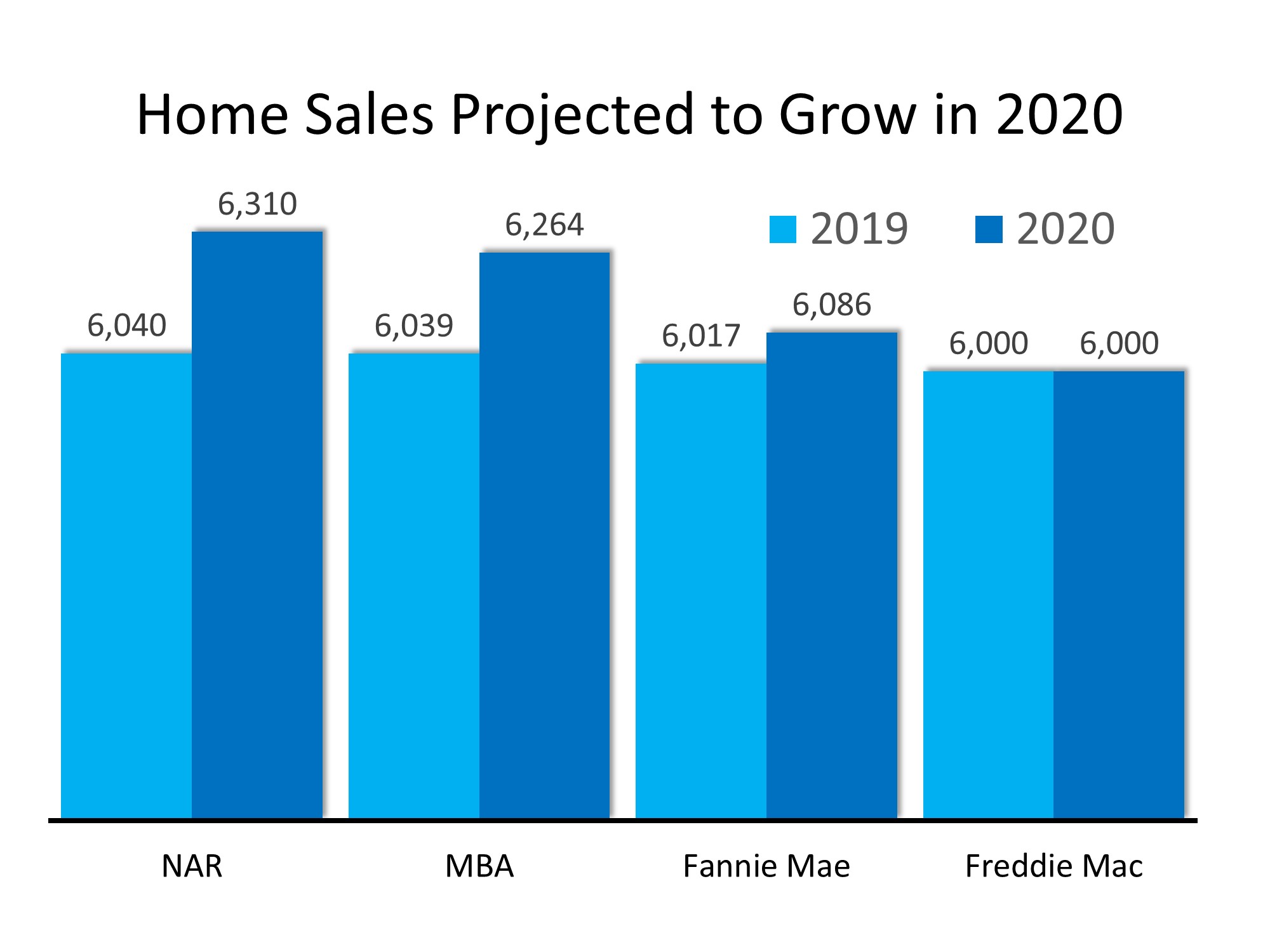

Three of four expert groups, the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae and Freddie Mac, also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable:

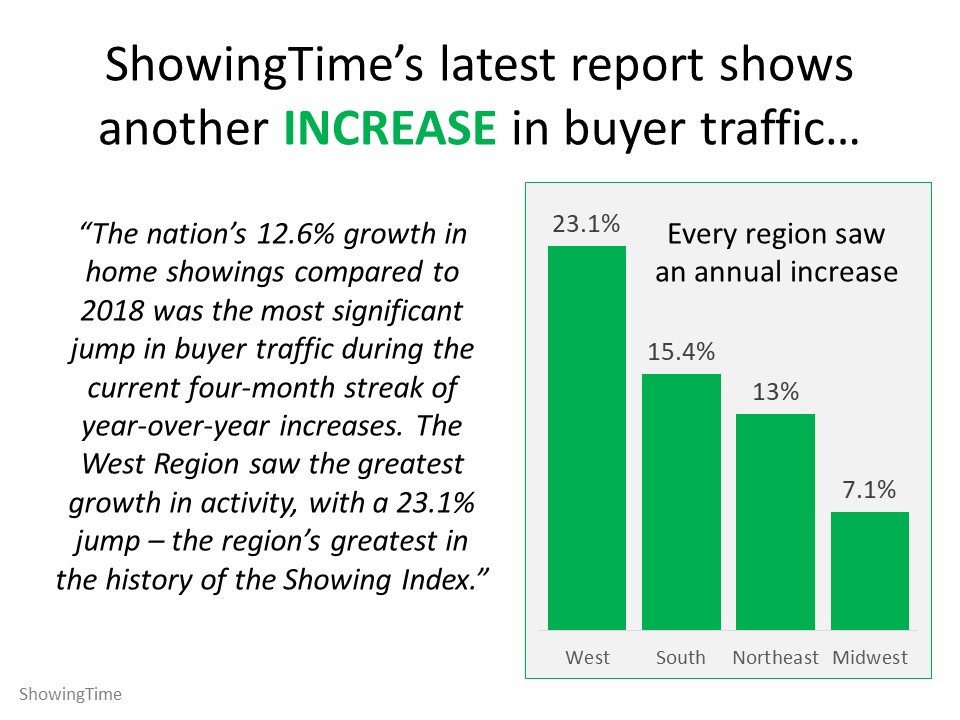

Showing Time, a popular software application that real estate agents use to schedule property tours for clients, reported a sharp uptick in appointments coming into the new year, a leading indicator of homebuyer interest:

The following are projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s Z Report, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA).

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

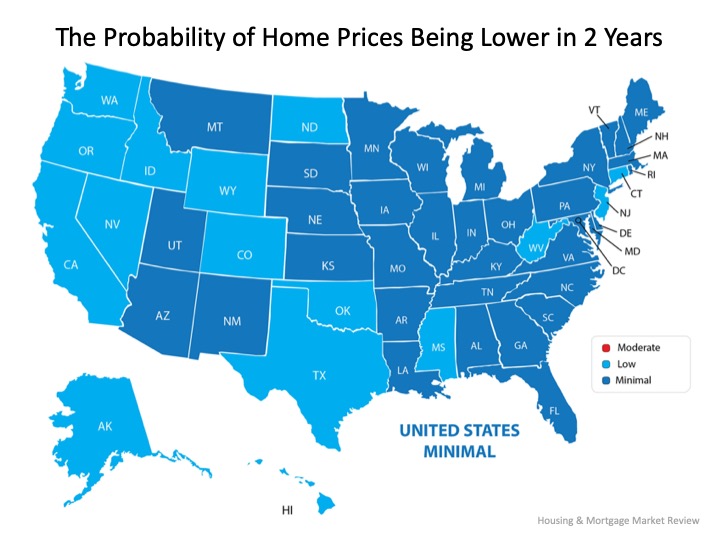

Additionally, ARCH Mortgage Insurance Company in their current Housing and Mortgage Market Review revealed their latest ARCH Risk Index, which estimates the probability of home prices being lower in two years. Based on the most recent results, 32 of the 50 U.S. states (plus D.C.) had a minimal probability of lowering by 2021.

BOTTOM LINE: With mortgage rates near all-time lows, a limited supply of inventory and growing demand for housing, prices will continue to appreciate at a moderate rate. 2020 looks to be a good, solid year for the real estate market.

Will We Have a Recession?

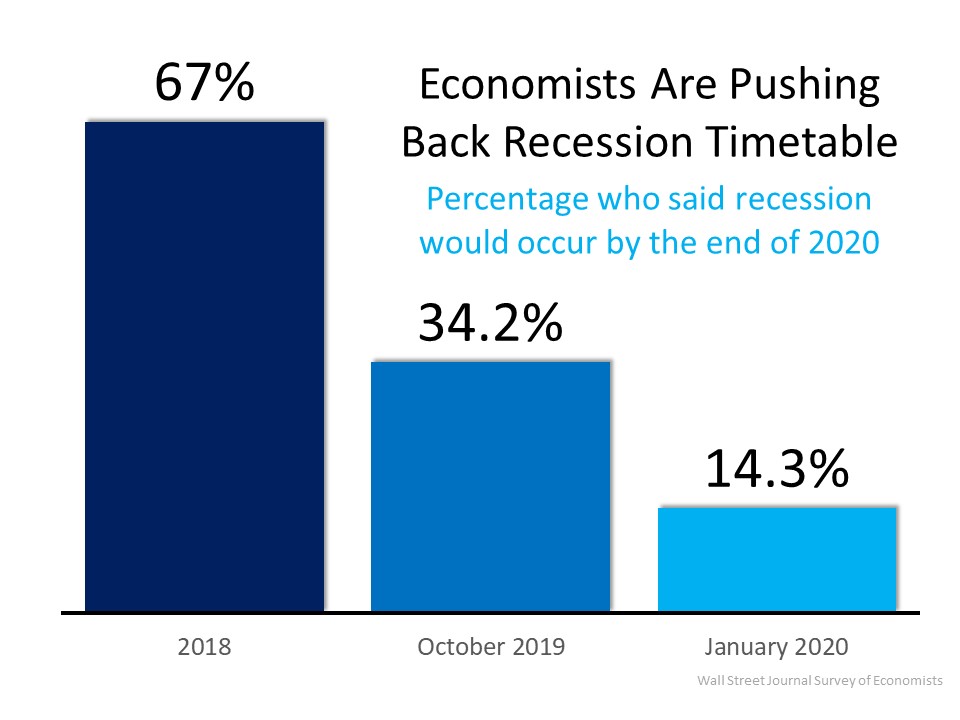

In early 2019, a large percentage of economists began predicting that a recession may occur in 2020. Additionally, a concurrent survey of potential home purchasers showed that over 50% agreed it would occur this year.

The economy, however, remained strong into the fourth quarter, and that has caused many to rethink that possibility. More and more experts are coming to the conclusion that the economy is doing well enough, stating that it may be later in 2021 before the economy slows down.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

So that’s good news, and Senior Economist at Realtor.com, George Ratiu agrees.

“Housing remains a solid foundation for the U.S. economy going into 2020.”

Housing is strong enough right now that it’s actually preventing recession from taking place. And if we take a look at the National Association of Realtors, the Mortgage Bankers Association, Fannie Mae and Freddie Mac, each of them project going forward into 2020 that we will have more homes sold than we did in 2019.

So it looks like we’re going to have a strong 2020 on the national level.

BOTTOM LINE: Keep an eye on the macroeconomy for unexpected changes, but know that the national housing outlook is positive for the next few years supported by economic fundamentals.

Reno-Sparks-Carson Market

Before we get to local housing market predictions, let’s examine the current local market environment.

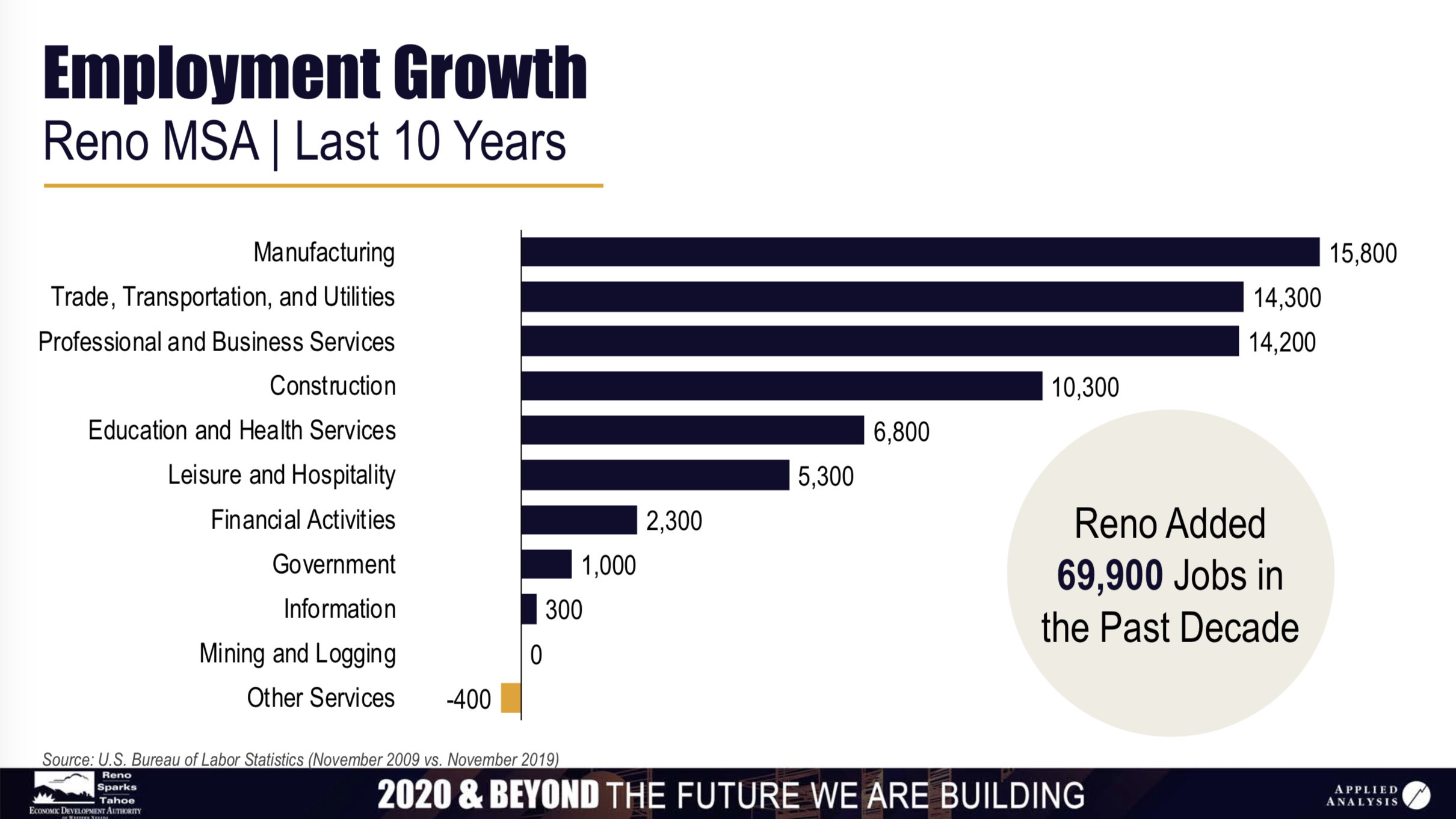

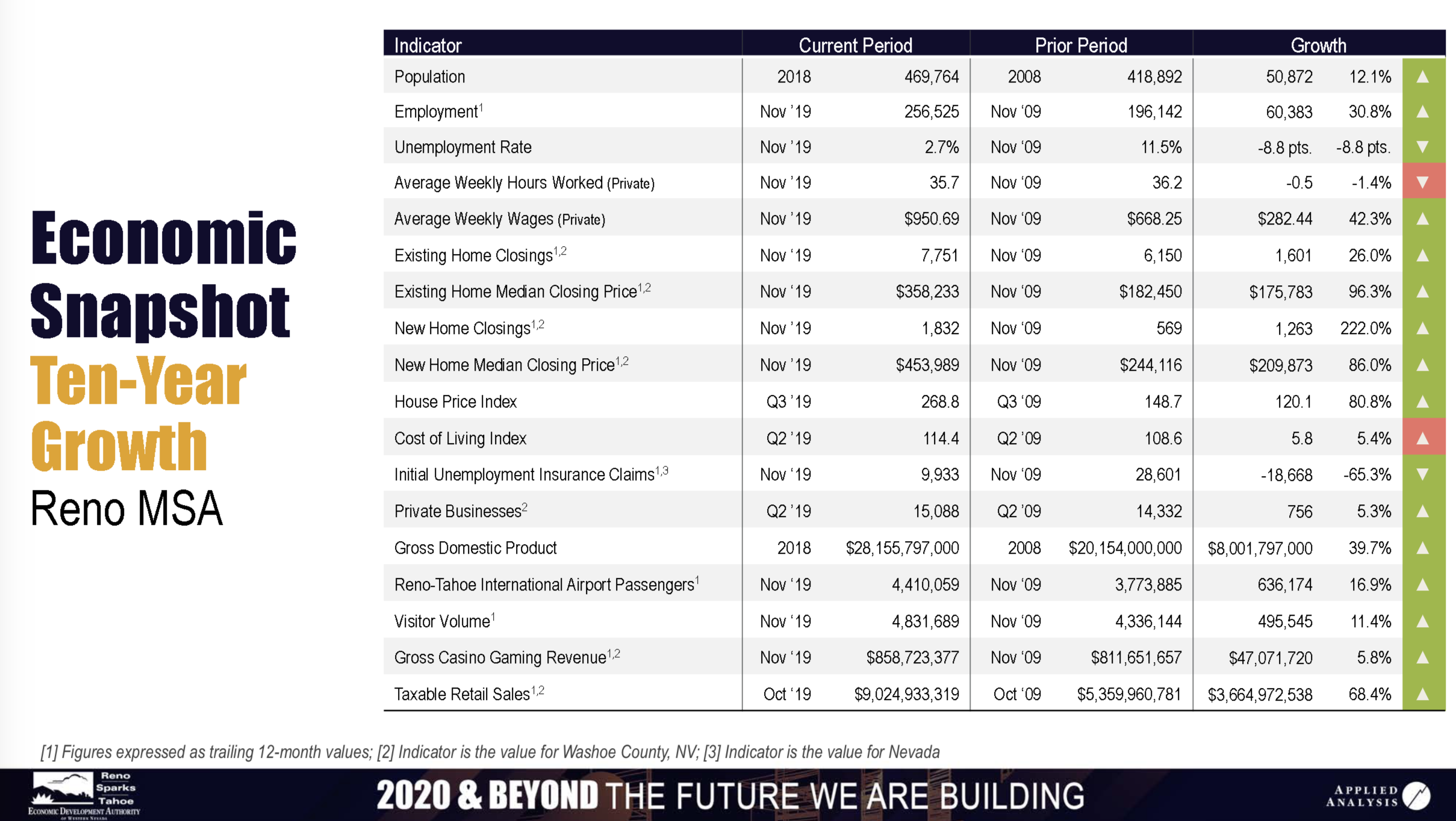

The Reno-Sparks metro has seen tremendous economic growth in recent years. In 2019 alone, 22 companies relocated to the area adding 1300 jobs, 40% in the technology sector.

Drawn by proximity to the greater west and a favorable tax climate, many have set up shop in the Reno Tahoe Industrial Center. Carson City now benefits as well, given new roads offering direct access to this development.

The success of this initiative has helped boost the entire region, which now has a pipeline of approximately $15.5 billion in commercial development projects.

Job growth in the area is expected to continue for at least the next five years, which creates the foundation for a solid housing market going forward. The Reno metropolitan area added 69,900 jobs in the past decade, 57,200 of them in the last five years.

On the spectrum of economic stability, when you look at the fundamentals, currently we’re on solid ground.

Nevada state population continues to grow, the majority of newcomers coming from California looking for a more favorable tax climate, job opportunities and a lower cost of living. As a result, the Reno metropolitan area is growing 3X faster than the US average.

BOTTOM LINE: Our local economy should continue to grow at a modest pace throughout 2020, creating a firm foundation for a solid housing market across the valleys.

Reno-Sparks-Carson New Homes

The demand for affordable homes in the Reno-Sparks-Carson region is high, but less than half of what’s needed is being built, according to the Nevada Builders Association. Rising land and labor costs, along with regulatory difficulties are limiting factors.

In September 2019, the city of Reno’s mayor created the 1000 homes in 120 days initiative to spur development to help alleviate the area’s housing crunch.

The program incentivizes housing development by deferring development costs like traffic impact and sewer connection fees for approved projects. Developers have the potential to defer up to $8,400 worth of fees per unit, to be paid at a later date, and construction must start within 18 months.

As of December 2019, the city had received applications for over 1600 units, so the program seems to have worked well.

Single-family home permits issued for 2020 indicate that over 2150 homes in 16 developments will be built in the region this year. However, the ongoing lack of inventory should continue to shore up pricing for entry-level homes.

BOTTOM LINE: Building permits are up, but not by enough to satisfy overall demand, which puts a floor on pricing for new homes coming online.

Reno-Sparks-Carson Resale Homes

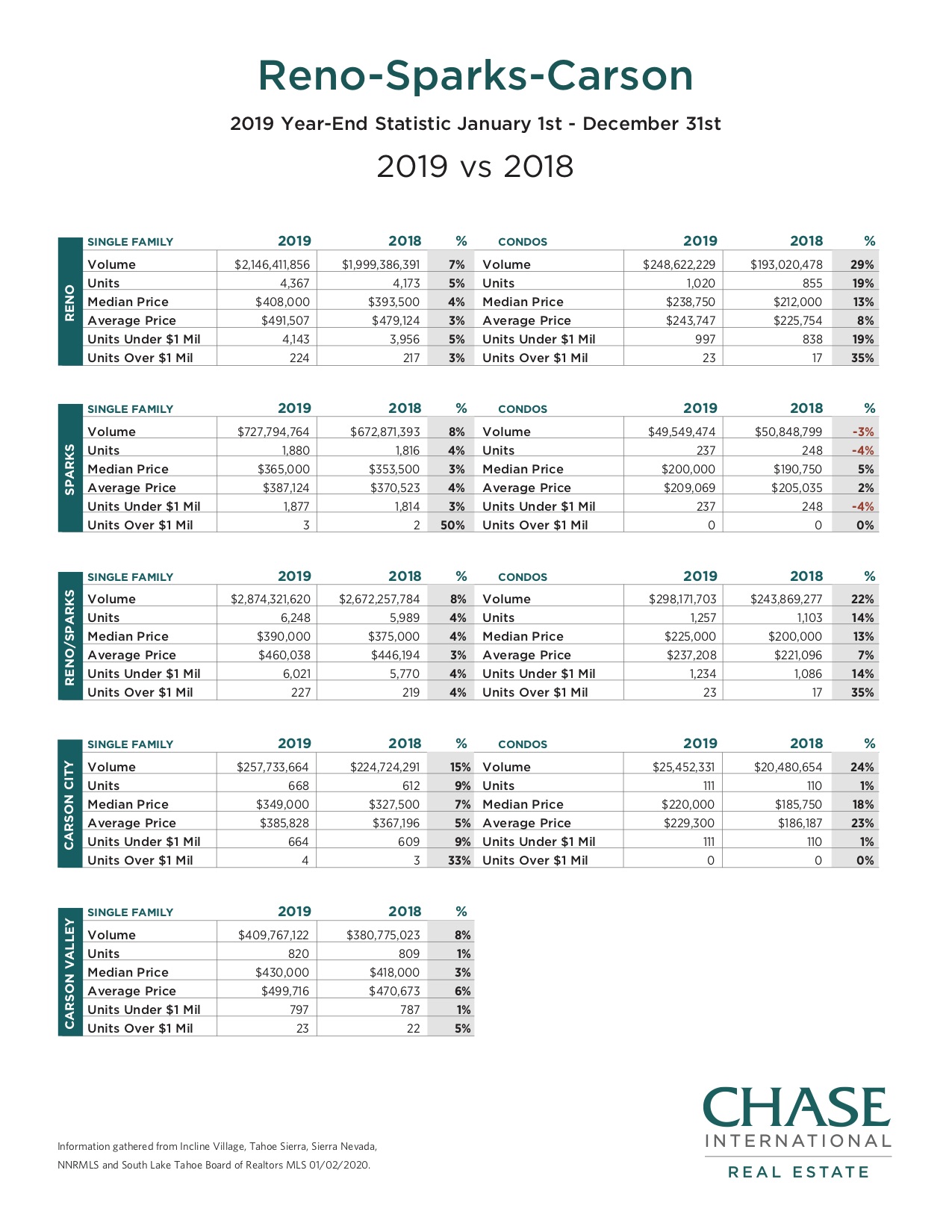

Reno-Sparks single-family home sales were up 4% in 2019 over 2018, settling at a median price of $390,000. Condo sales were up 14% with a median price of $225,000.

Inventory continues to be tight in the Reno-Sparks metro, typically averaging under two months, and we expect this theme to continue throughout the 2020 selling season.

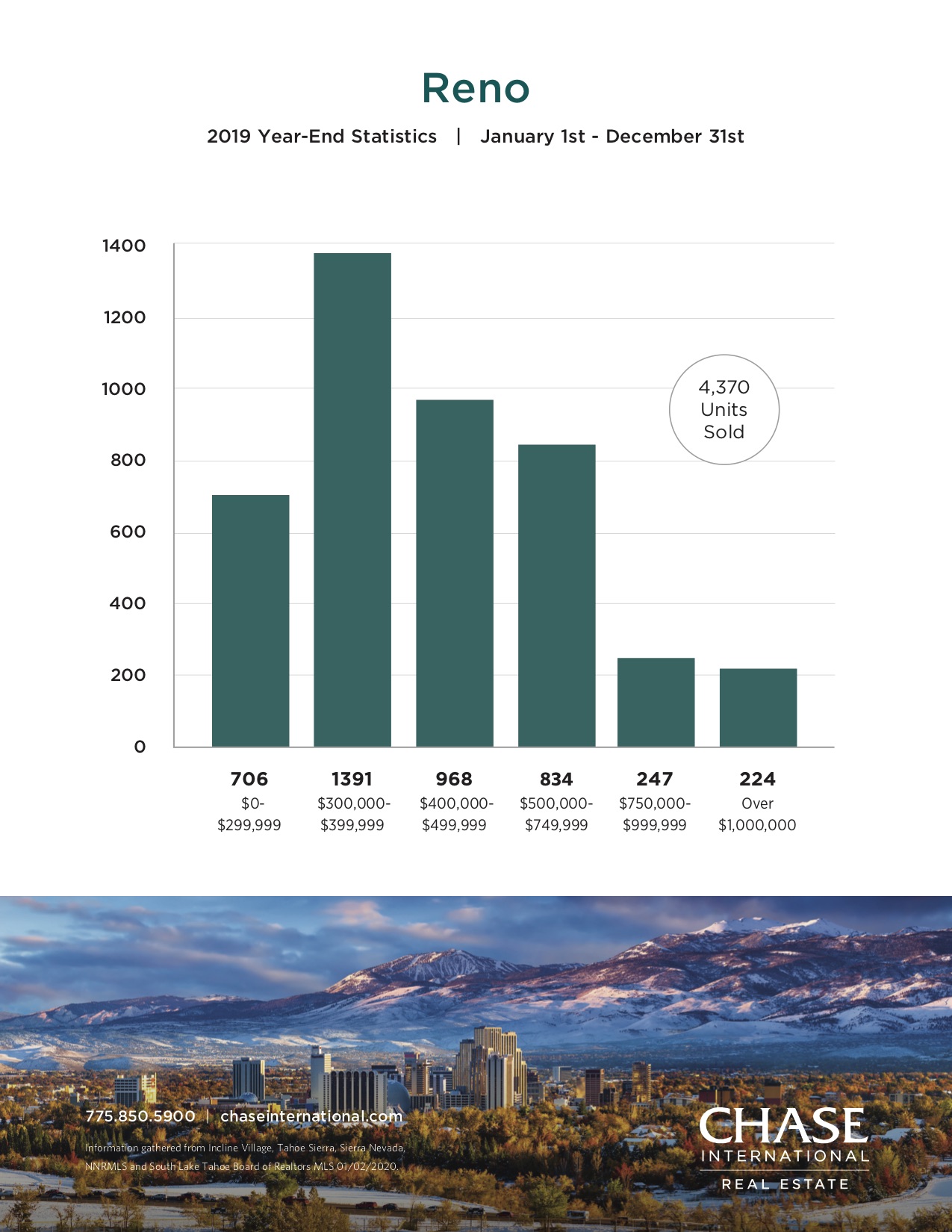

These are the 2019 Reno home sales by price band. As you can see, under $400,000 is the most active segment of the market representing 48% of sales.

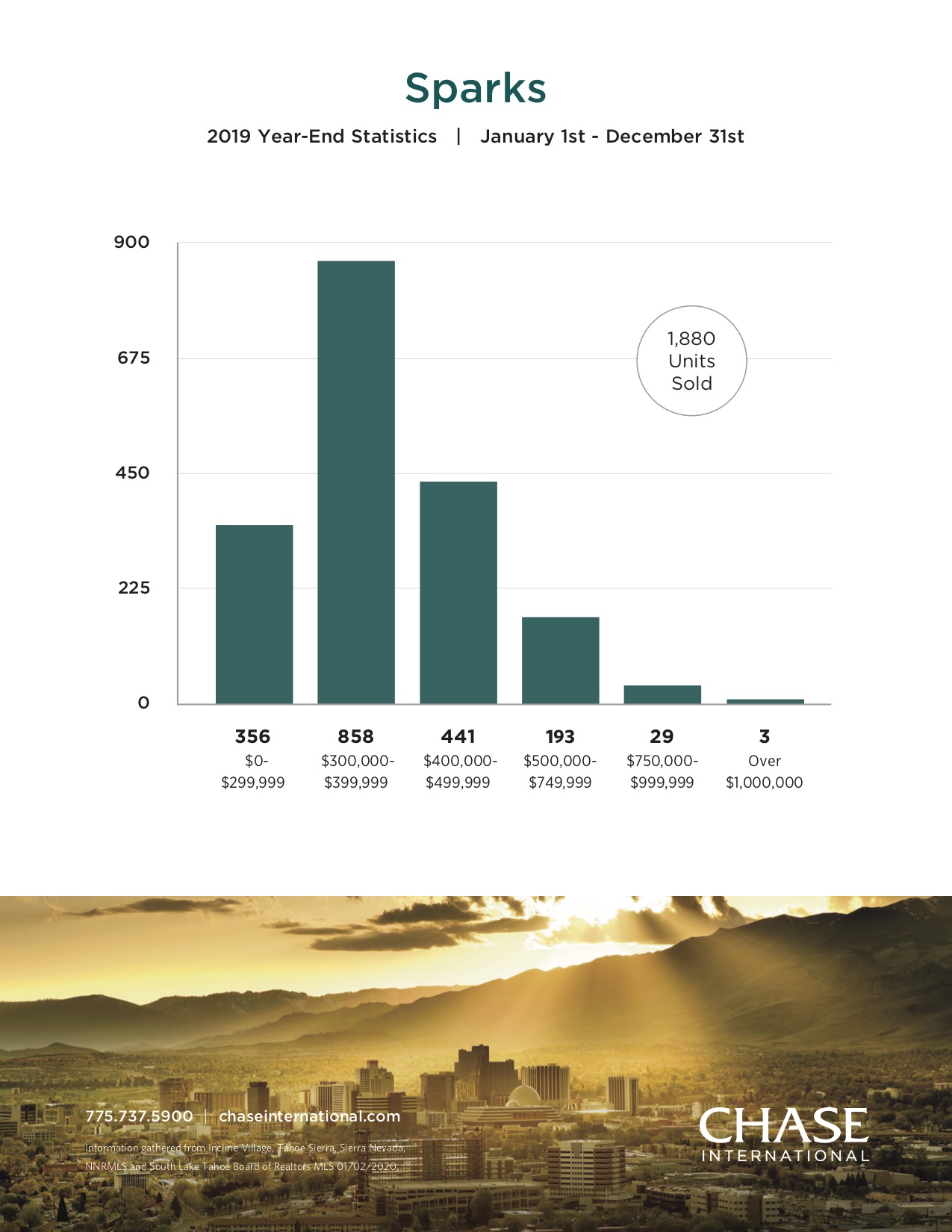

These are the 2019 Sparks home sales by price band. As you can see, under $400,000 is the most active segment of the market representing 65% of sales.

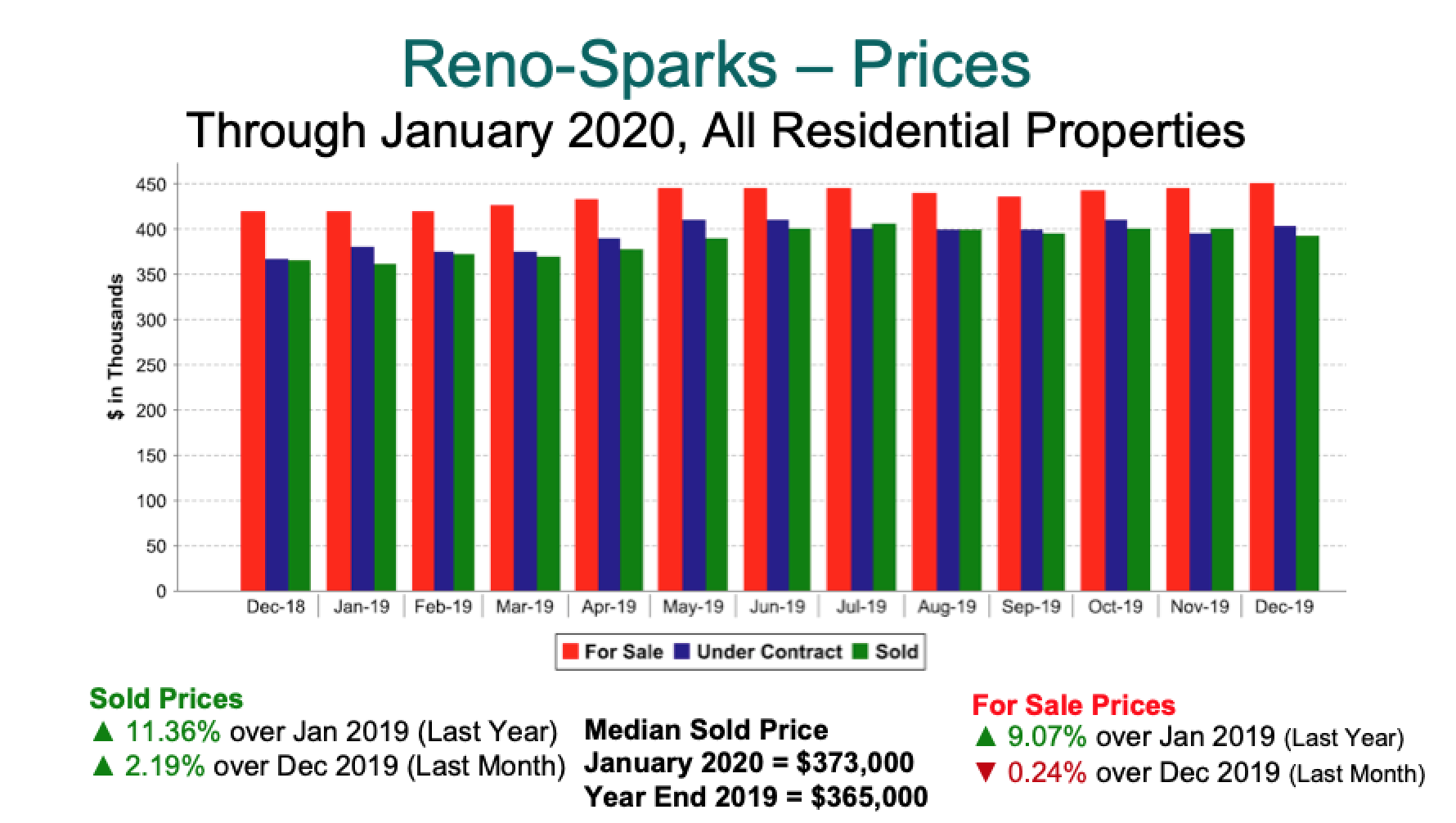

Here's an updated home price chart for Reno-Sparks from 2019 through January 2020:

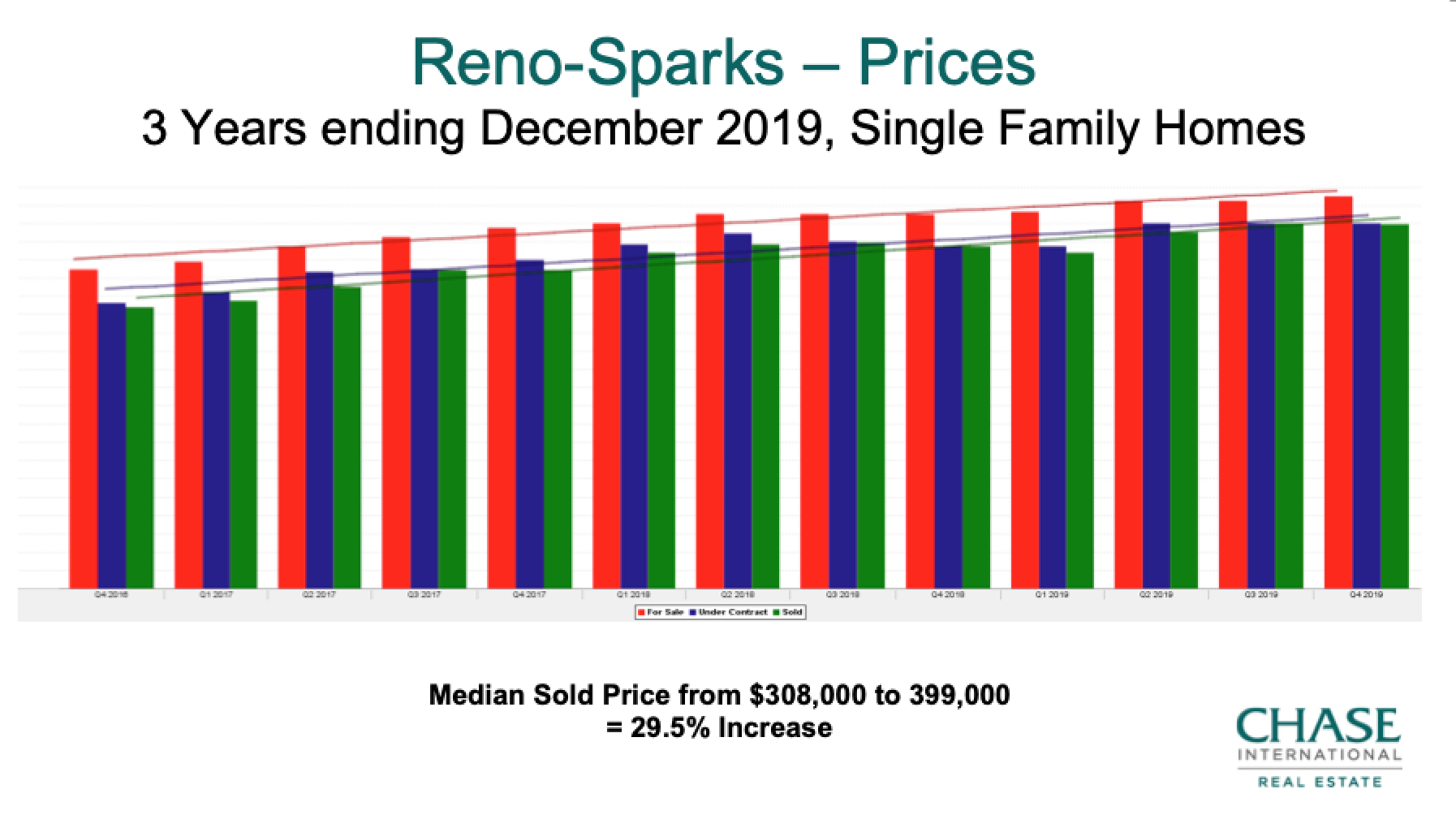

This is the Reno-Sparks 3-year pricing trend, note the 29.5% increase:

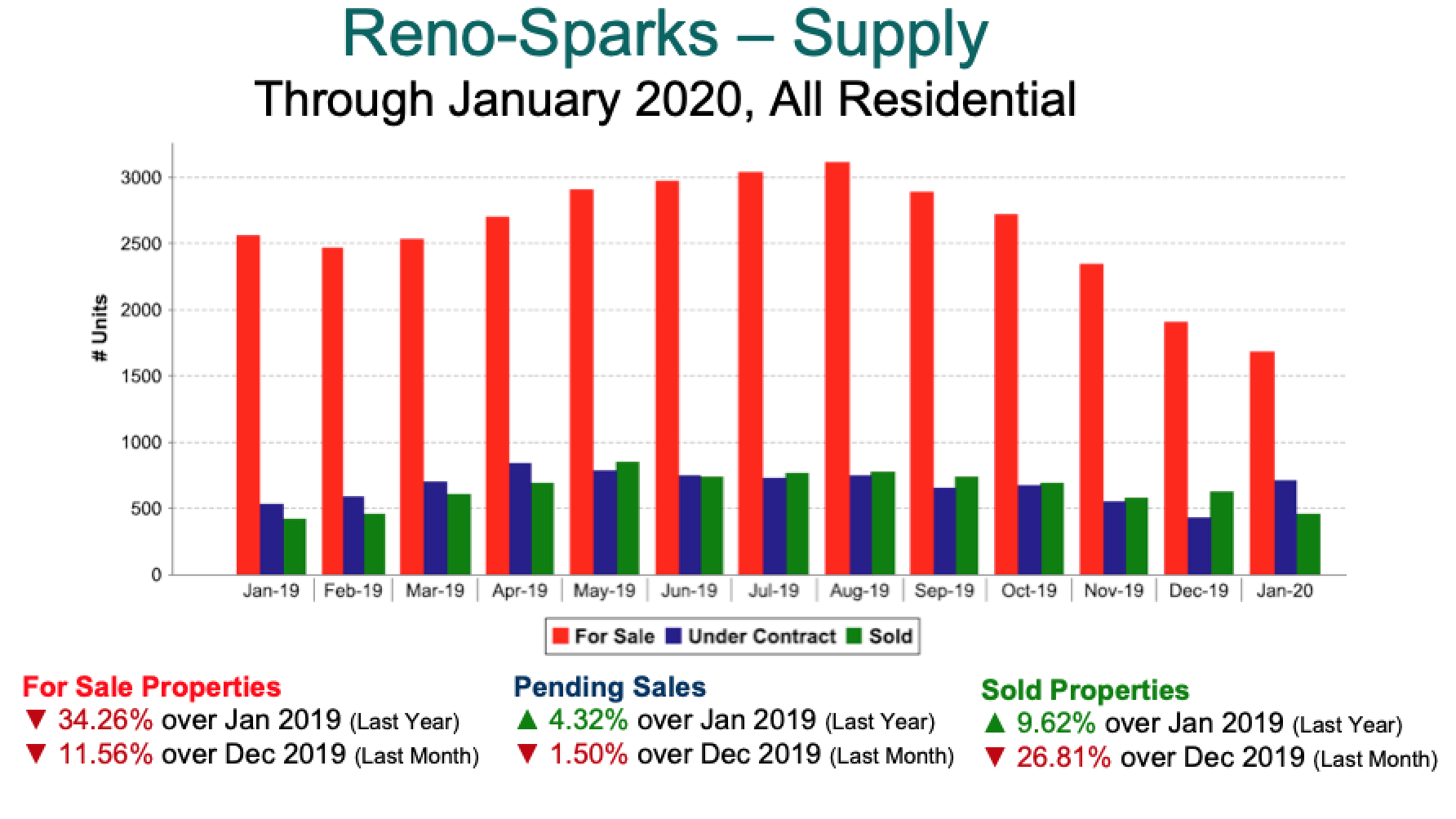

Here's an updated chart from 2019 through January 2020 illustrating supply trends. Note how January pending sales are up year-over-year:

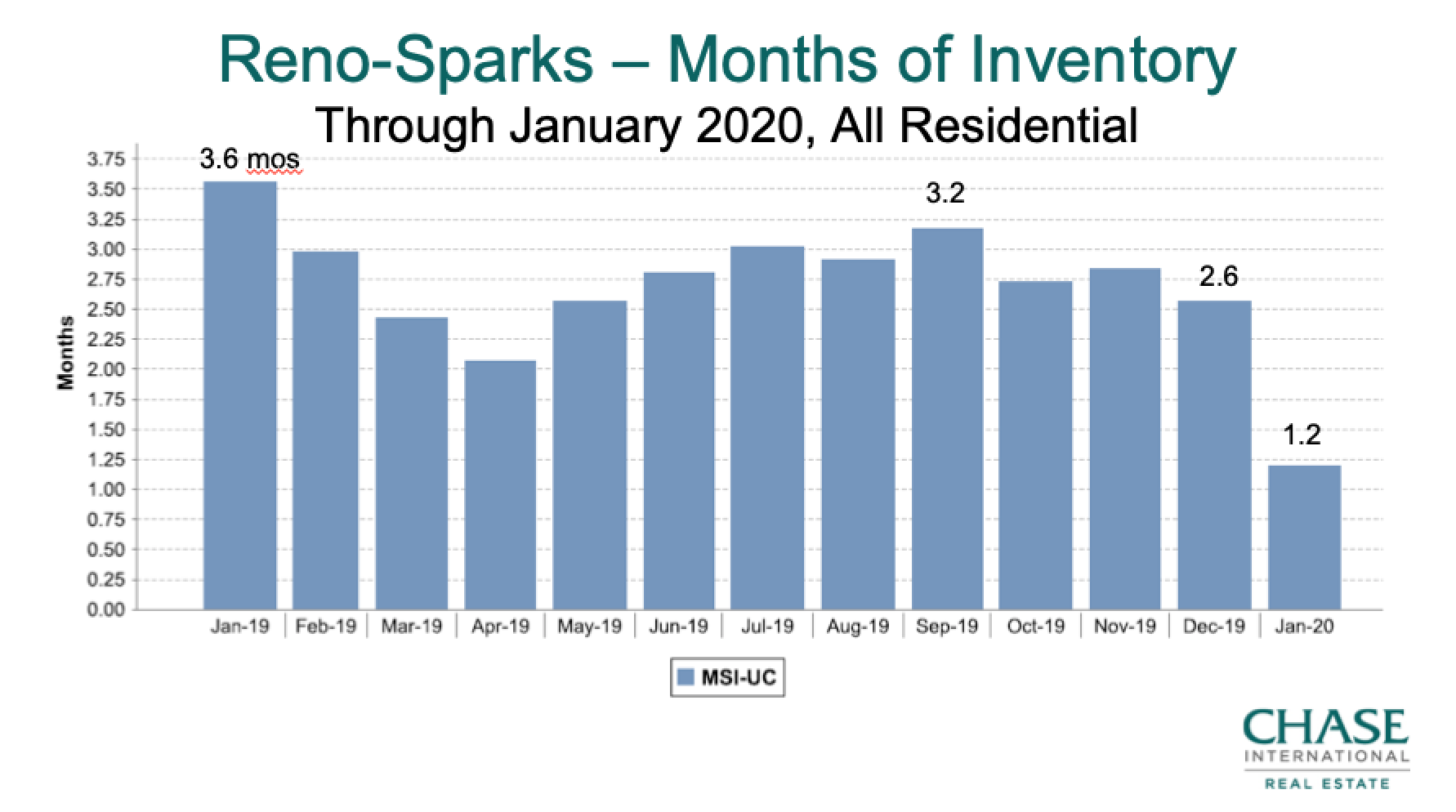

This chart illustrates Reno-Sparks months' supply of inventory levels for 2019 through January 2020. Note the 1.2 months' supply at the end of January, which is incredibly low:

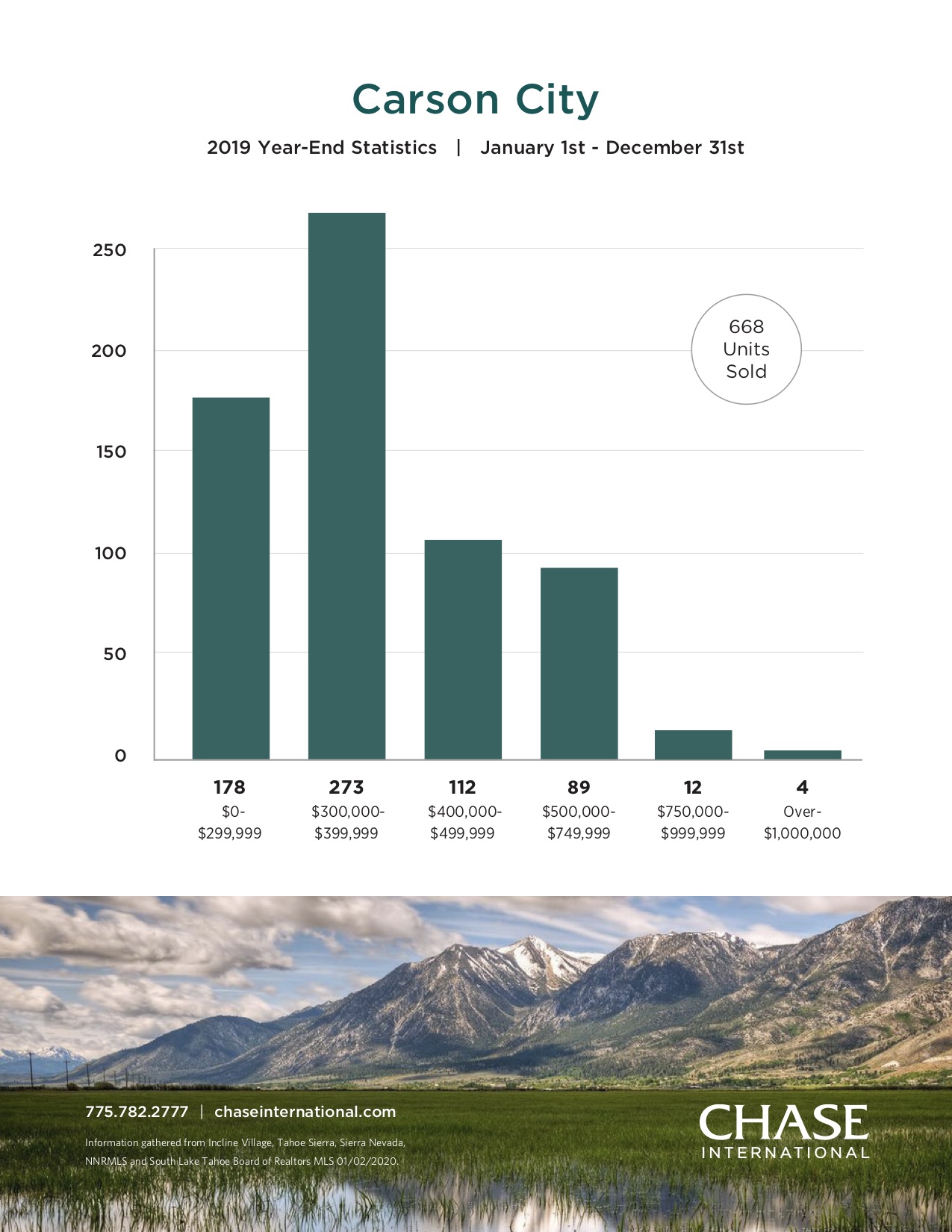

Carson City single-family home sales were up 9% in 2019, with a median price of $349,000. Condo sales were up 1% and ended the year at $220,000.

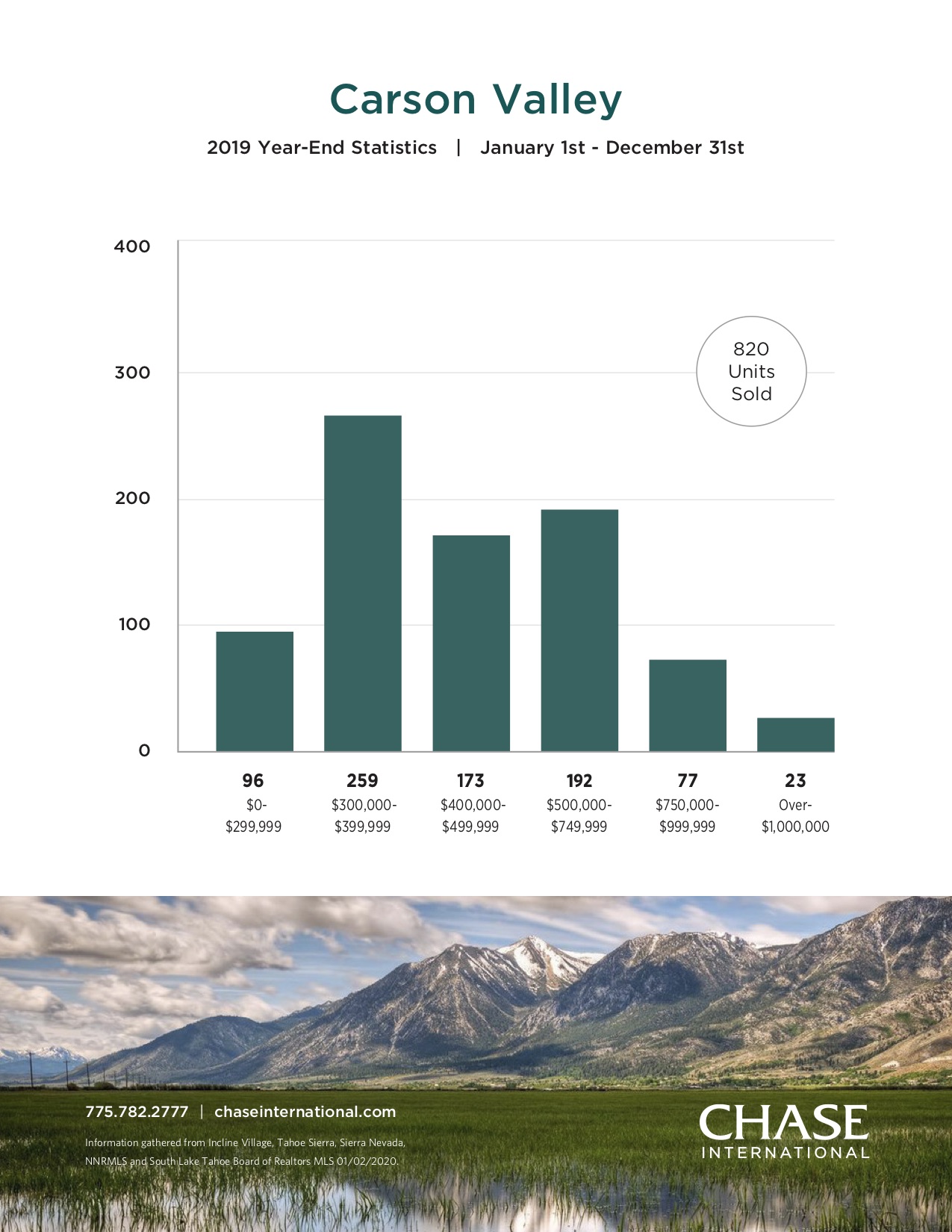

Carson Valley single-family home sales were up 1% in 2019 over the year prior, settling on a median price of $430,000.

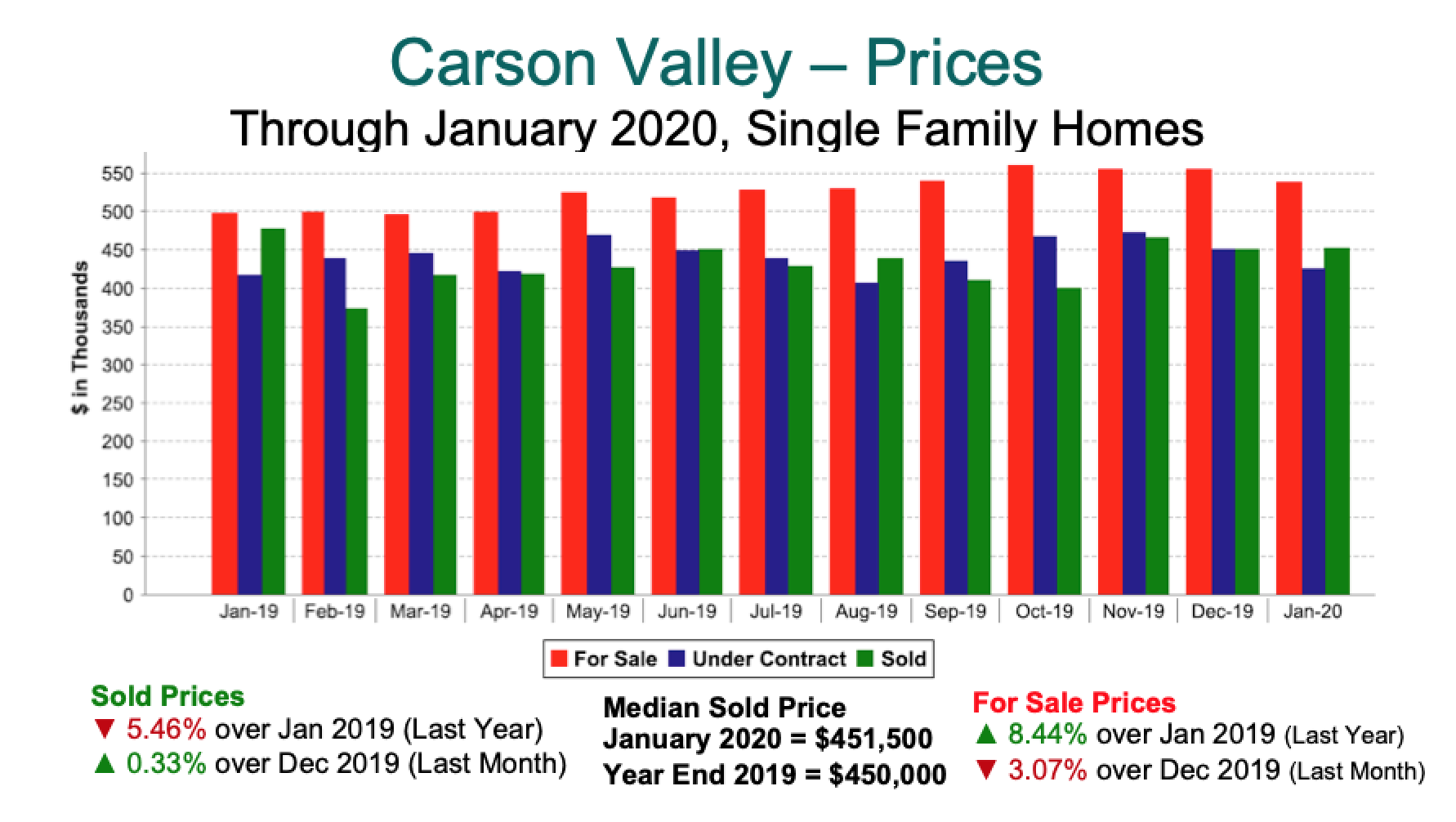

Here's a chart from 2019 through January 2020 showing Carson Valley pricing:

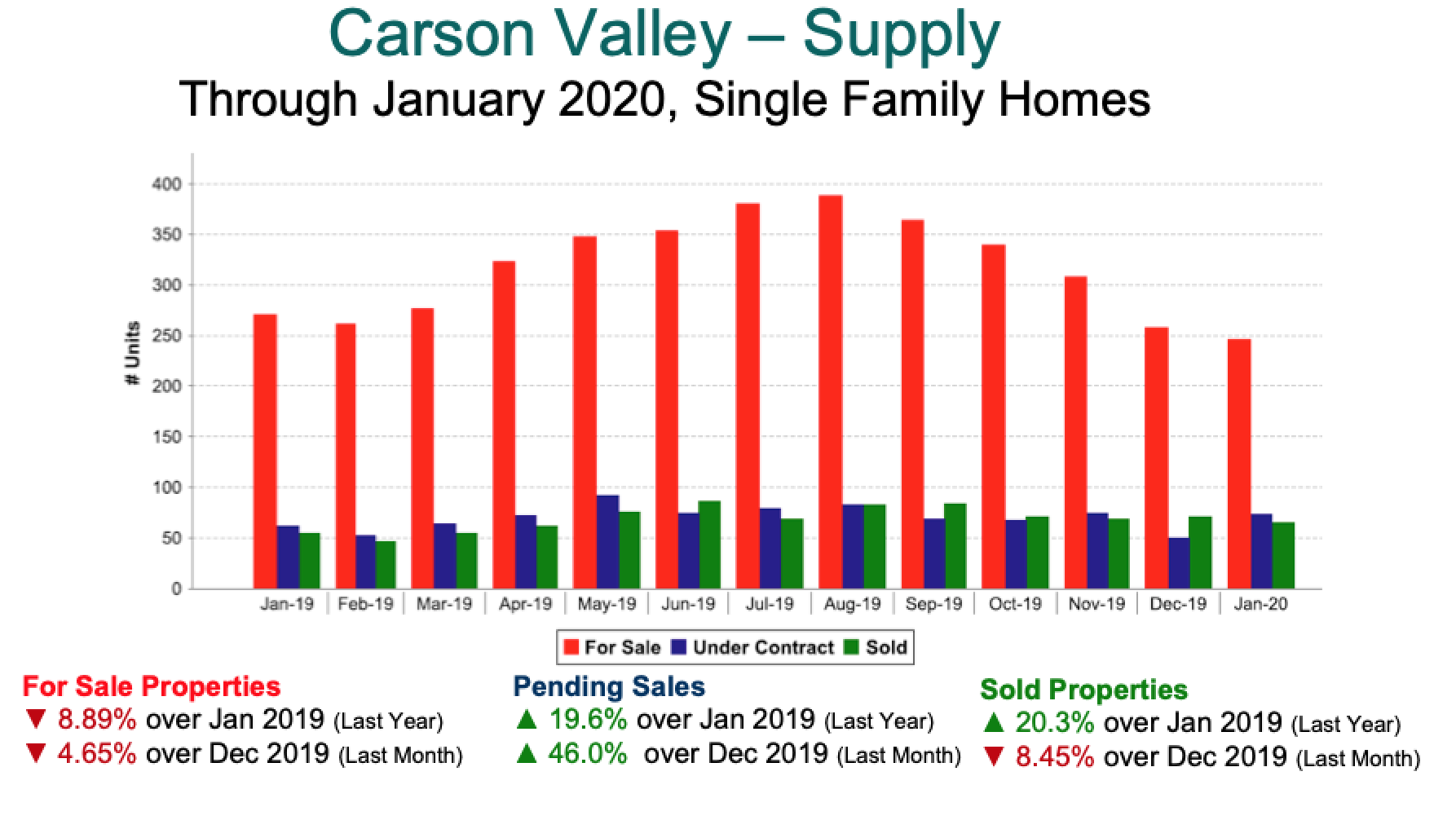

Carson Valley supply trends for 2019 through January 2020:

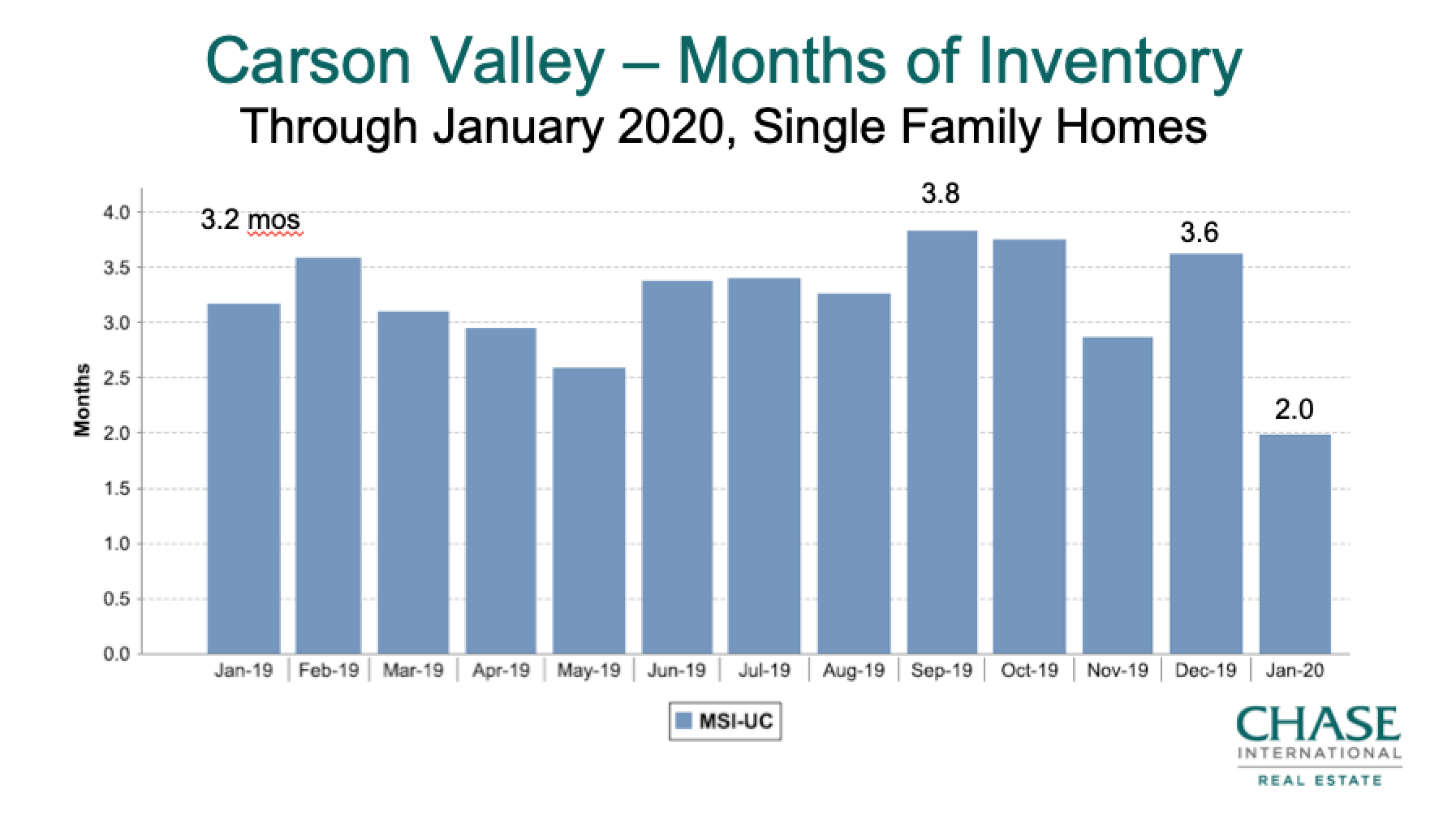

Carson Valley months supply of inventory trends from 2019 through January 2020, note the 2-month supply in January, which is incredibly low for this area:

BOTTOM LINE: Prices and unit sales in Reno-Sparks-Carson will increase moderately as the local economy continues to expand. Inventory shortages in the under $400,000 price range will continue to be a challenge, with value-priced homes selling quickly. Sellers may be able to test the market somewhat with pricing, while buyers must be prepared to compete to secure the very best properties.

Tahoe-Truckee Market

Tahoe-Truckee is primarily a vacation-resort market, driven by economic factors in California and the Greater Bay Area. So let’s look at regional trends there.

CALIFORNIA ECONOMY:

UCLA’s Anderson School 2020 forecast is predicting that California’s economic growth will slow toward the end of the year, though it will still outshine the rest of the nation.

California’s major population centers (with the exception of Sacramento and Los Angeles) experienced above 2% job growth in 2019.

High-income sectors such as information, business and professional services grew more slowly, while government, administrative, manufacturing and private education hiring grew at a faster pace.

The logistics and tech sectors are booming and should continue strong well into the new year, significant drivers in the San Francisco Bay Area economy.

Unemployment rates in 2020 are expected to average 4.3%, still quite low. Real personal income is expected to grow by 2%, reflecting the tight labor market, especially for high-earner positions.

BAY AREA HOUSING:

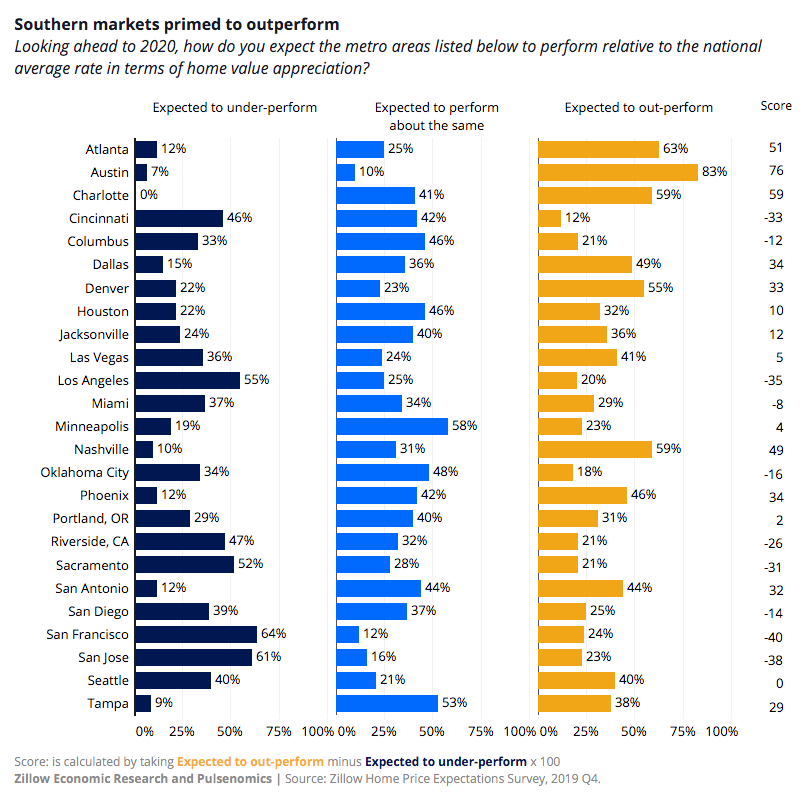

Bay Area home prices have been flat or falling for 18 months, with buyer fatigue solidifying in 2019 after a multi-year runup.

In a Zillow survey of more than 100 economists and local real estate professionals, most believed that prices would rise more slowly in Bay Area cities in 2020 than the 2.8% predicted for the nation.

Chart courtesy of Zillow Research

Many real estate market observers are bearish on California housing because high prices have pushed homeownership out of reach for so many. However, strong employment and low interest rates will likely support the market.

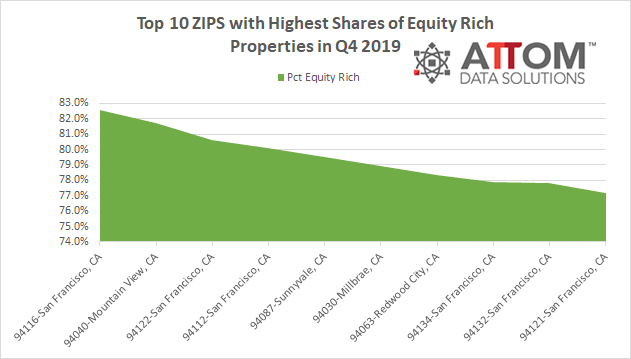

Even as price appreciation slows, many Bay Area homeowners are sitting on record amounts of home equity. 65.9% of homes with loans in San Jose and 57.5% in San Francisco have more than 50% equity, according to ATTOM Data Solutions.

Chart courtesy of ATTOM Data Solutions

With the median Bay Area home price at $928,000, homeowners with over 50% equity could easily peel off a chunk to buy a condo in Tahoe.

LAKE TAHOE-TRUCKEE HOUSING:

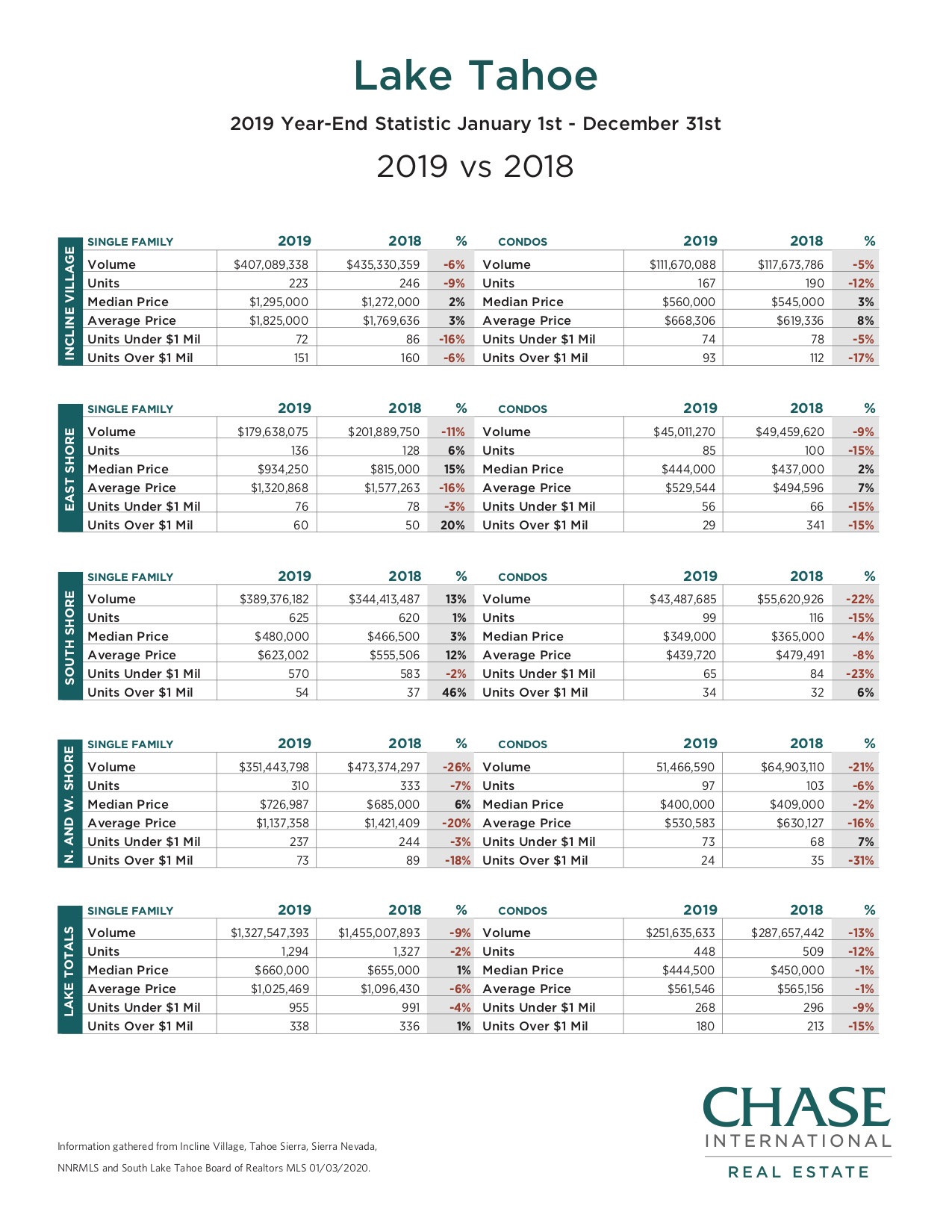

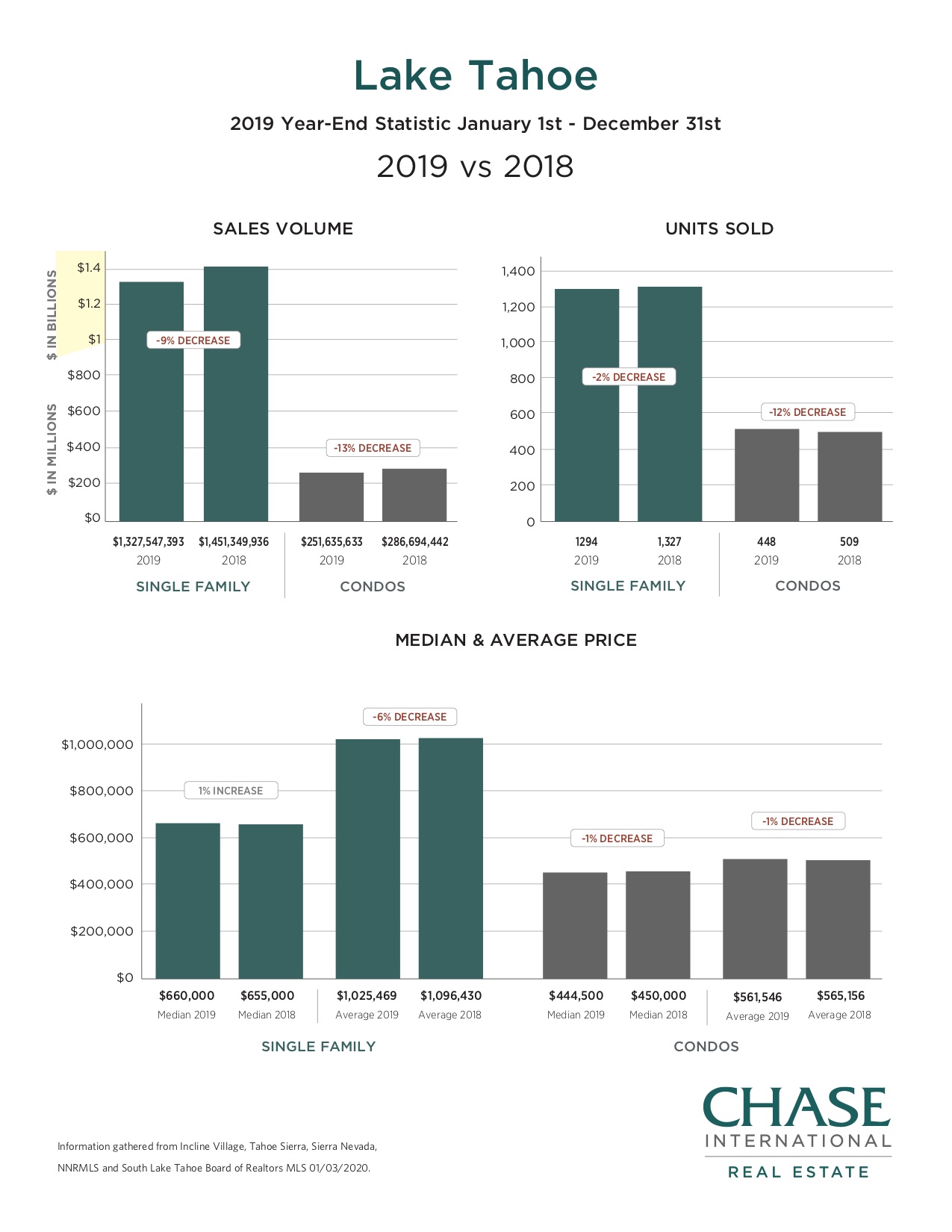

Single-family home sales in the Lake Tahoe basin declined by 2% in 2019, with the median price settling at $660,000, 1% higher than the year before. Condo sales decreased by 12%, with the median price at $444,500, 1% lower than in 2018.

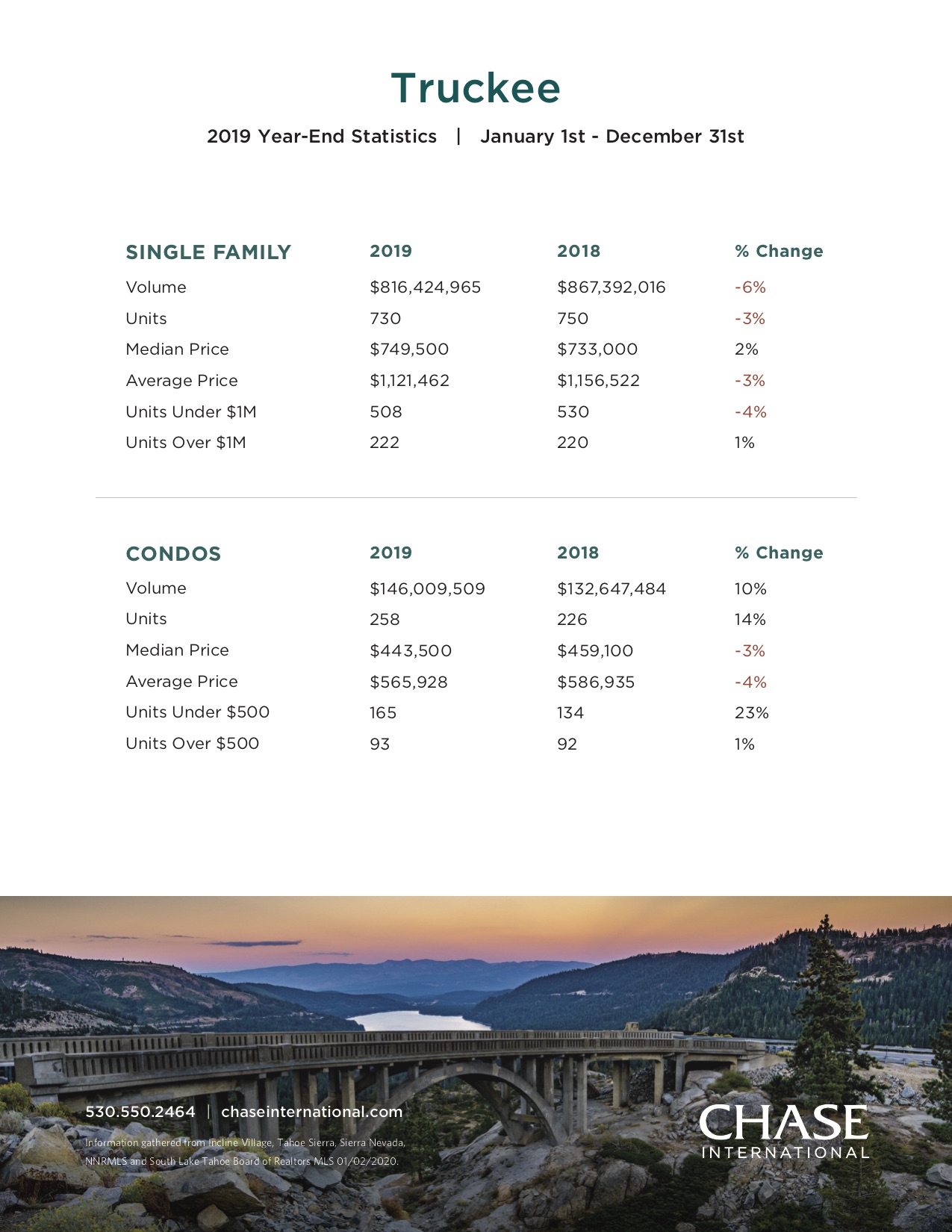

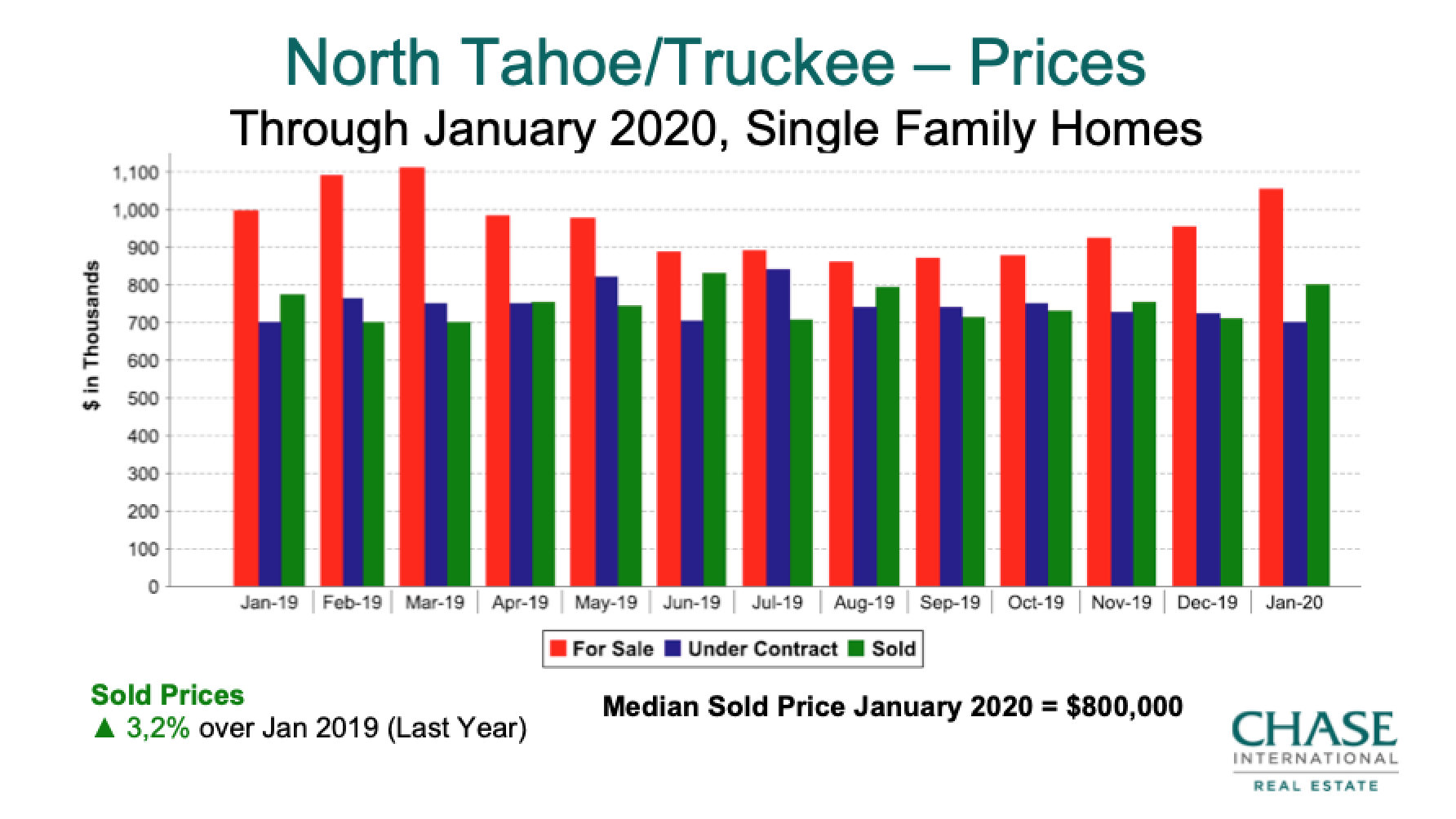

In Truckee, single-family home sales declined 3% in 2019, as the median price settled at $749,500, 2% higher than the prior year. Condo sales increased 14%, as the median price dropped to $443,500, 3% lower than in 2018.

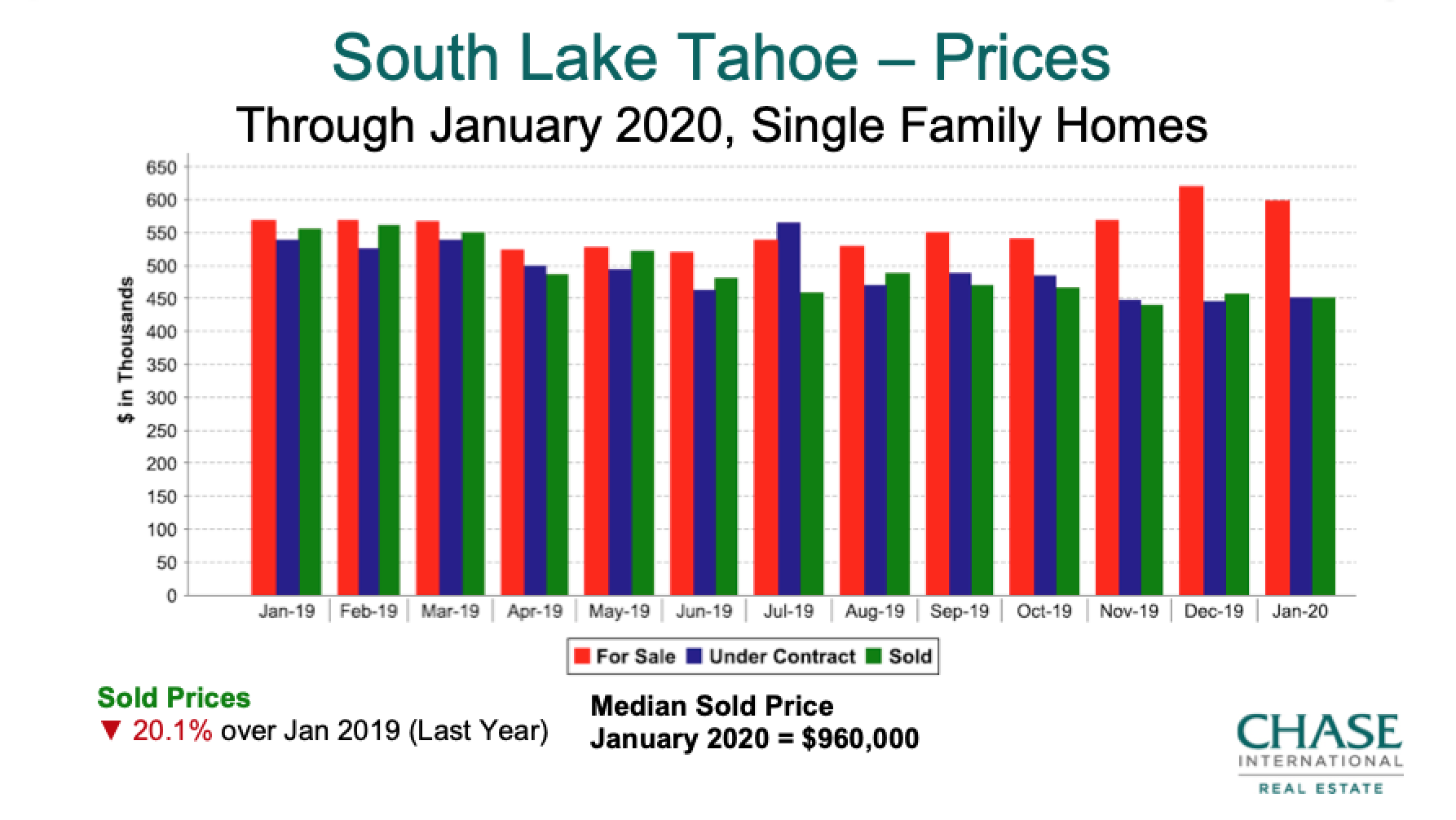

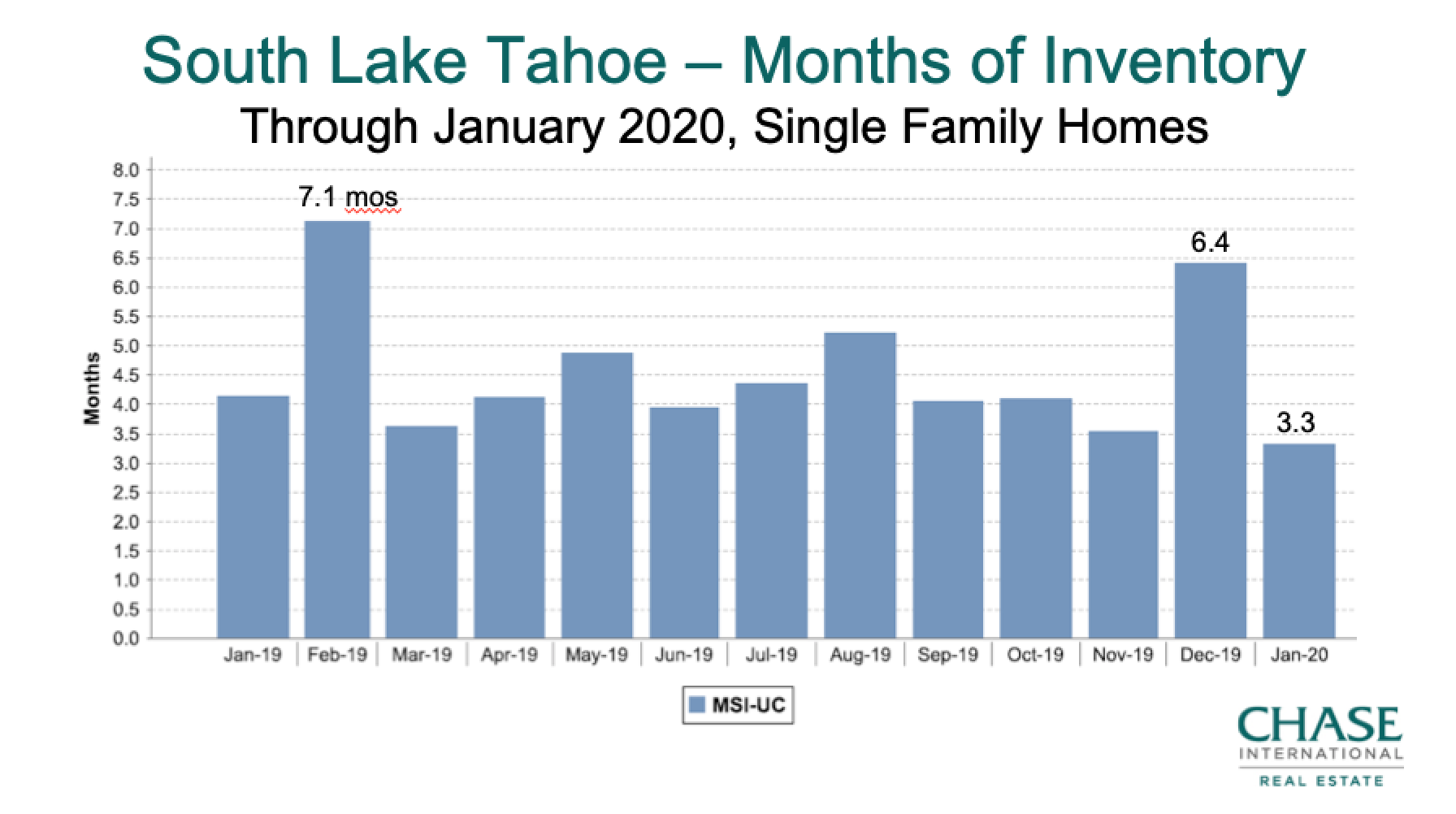

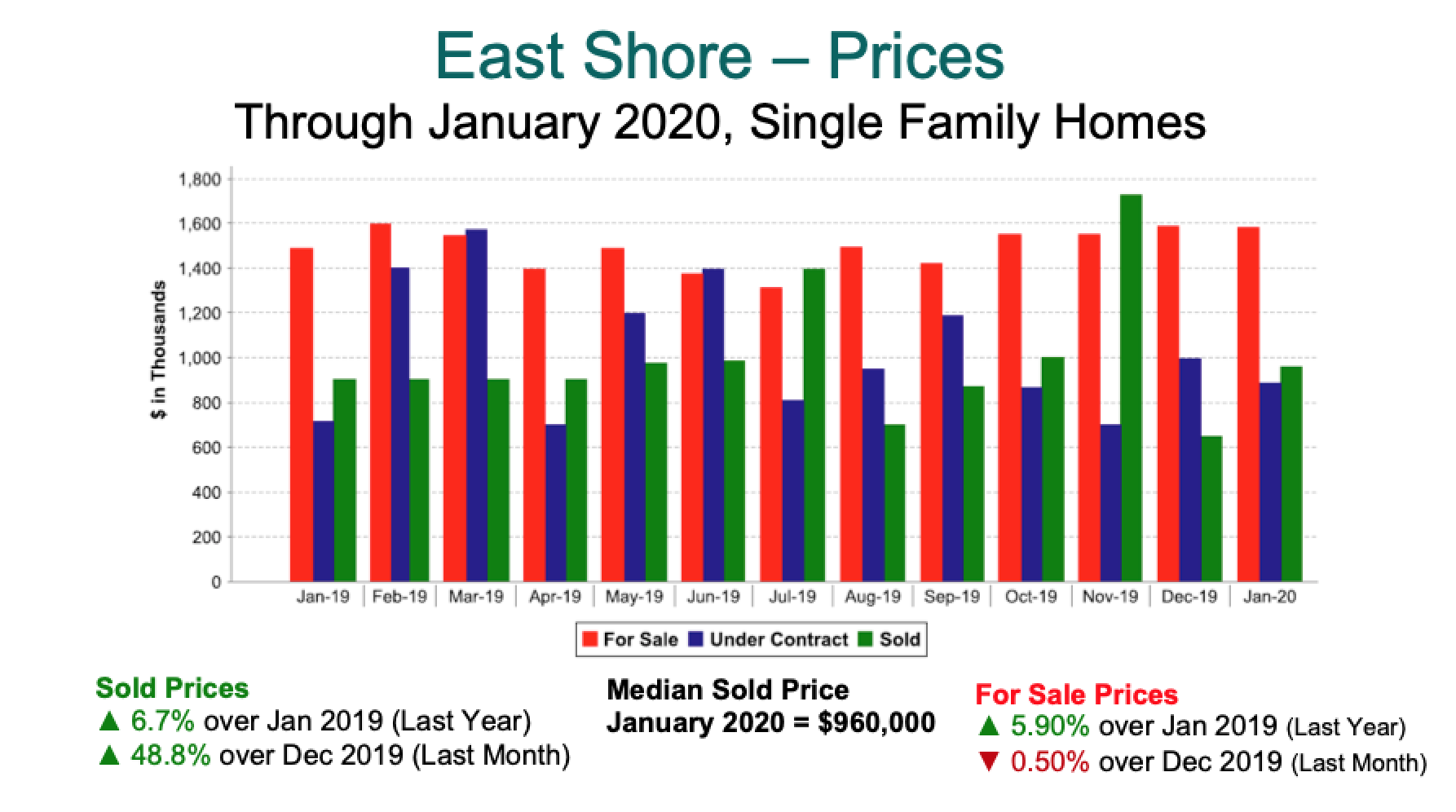

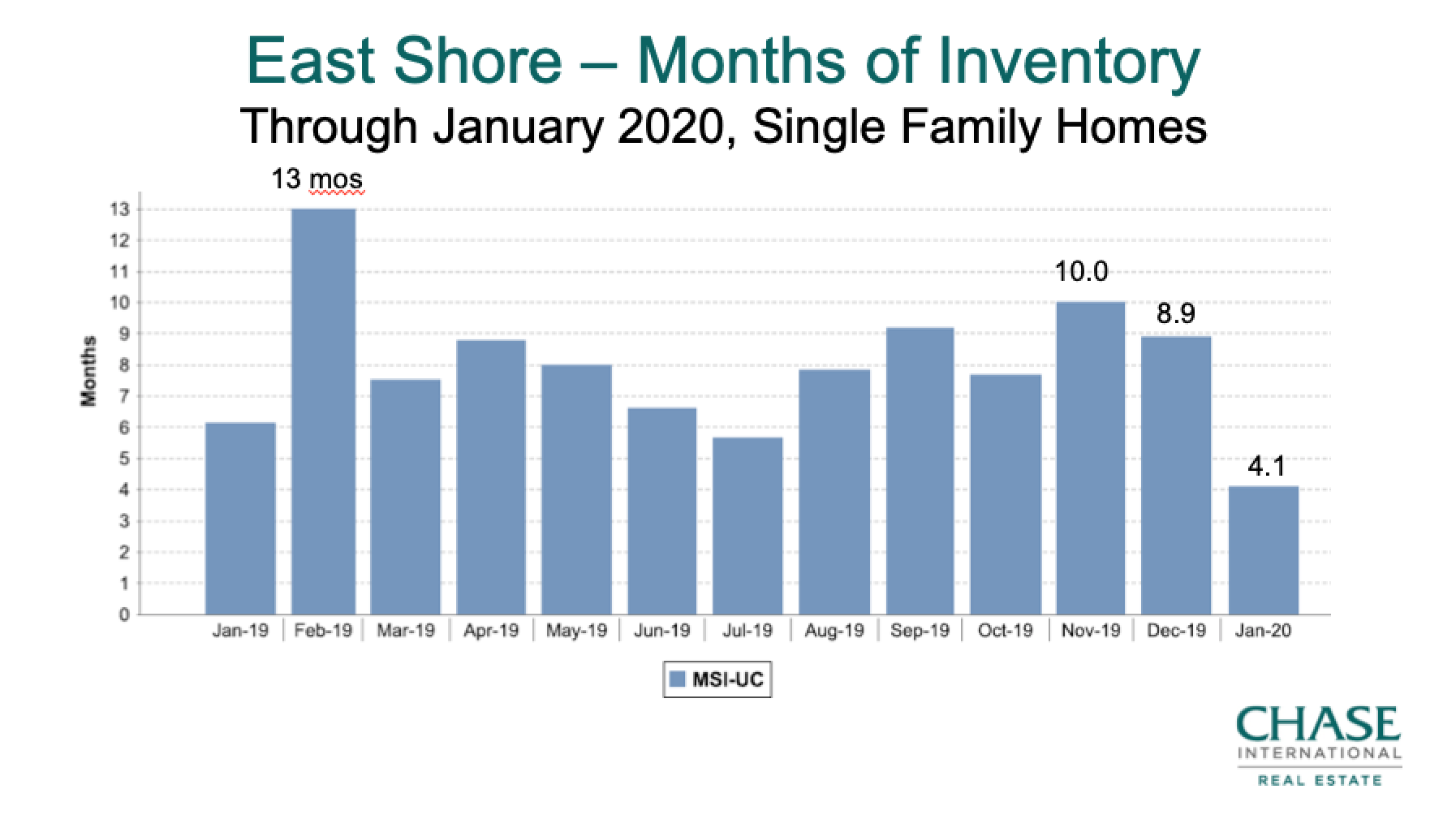

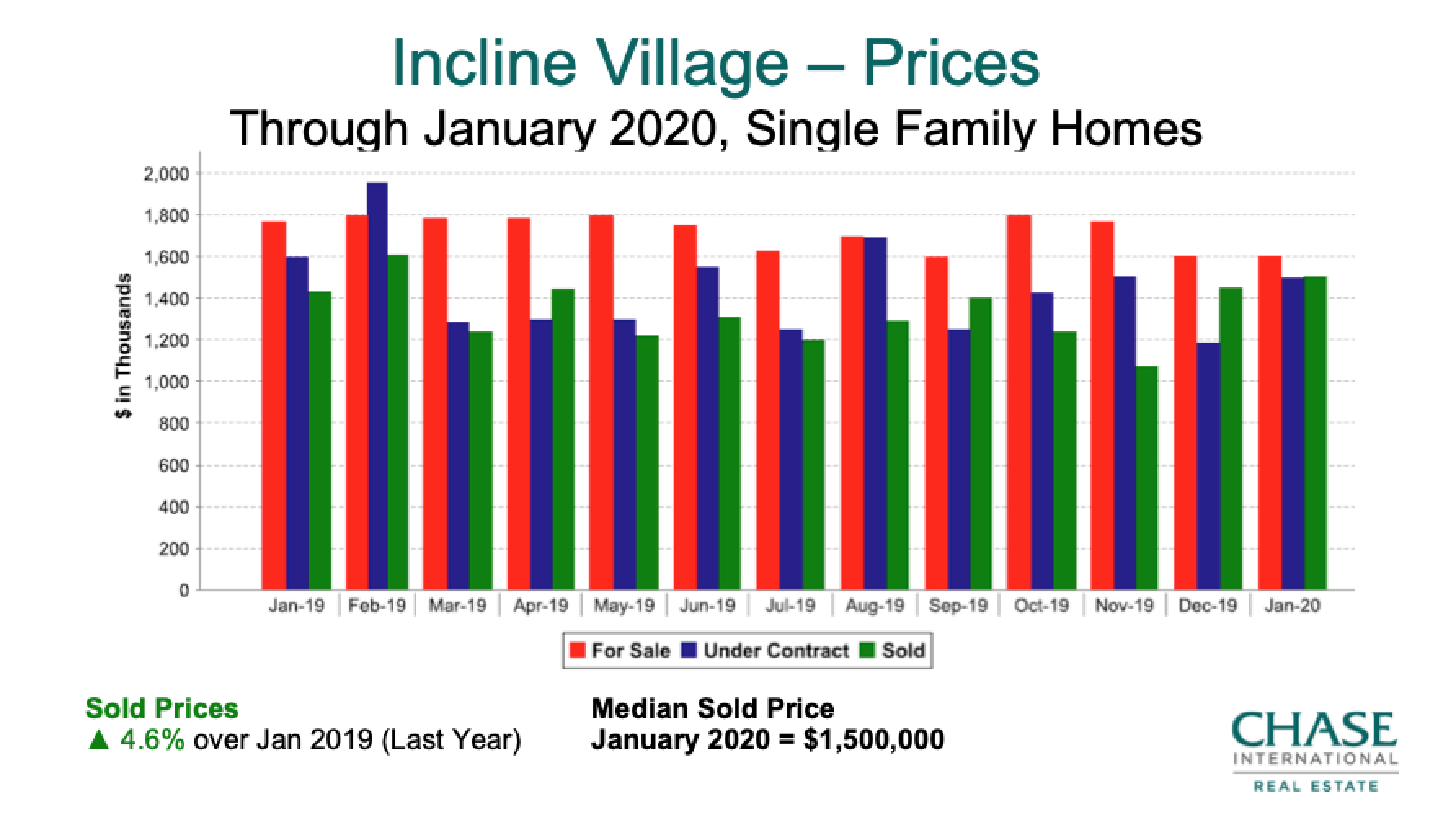

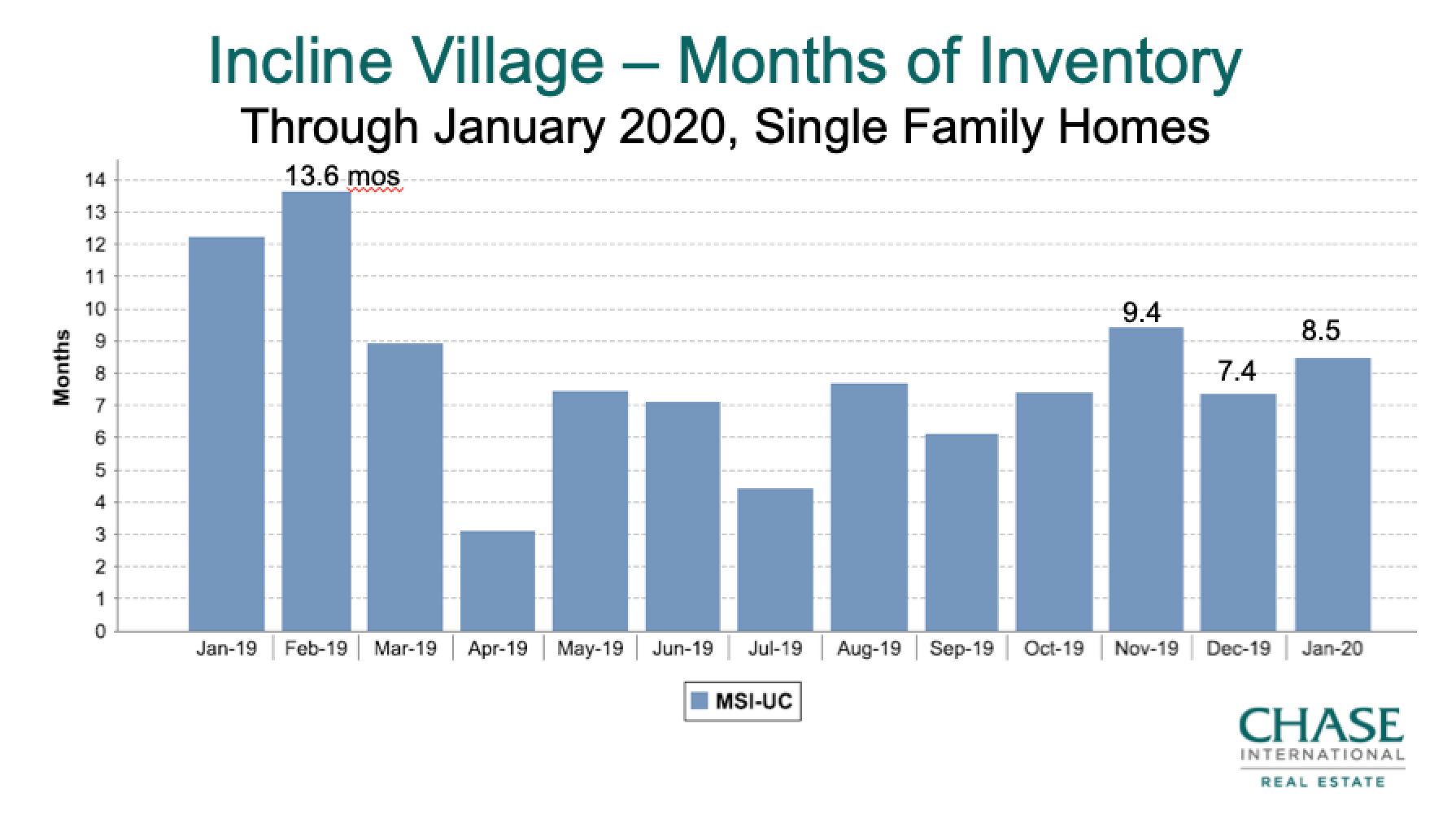

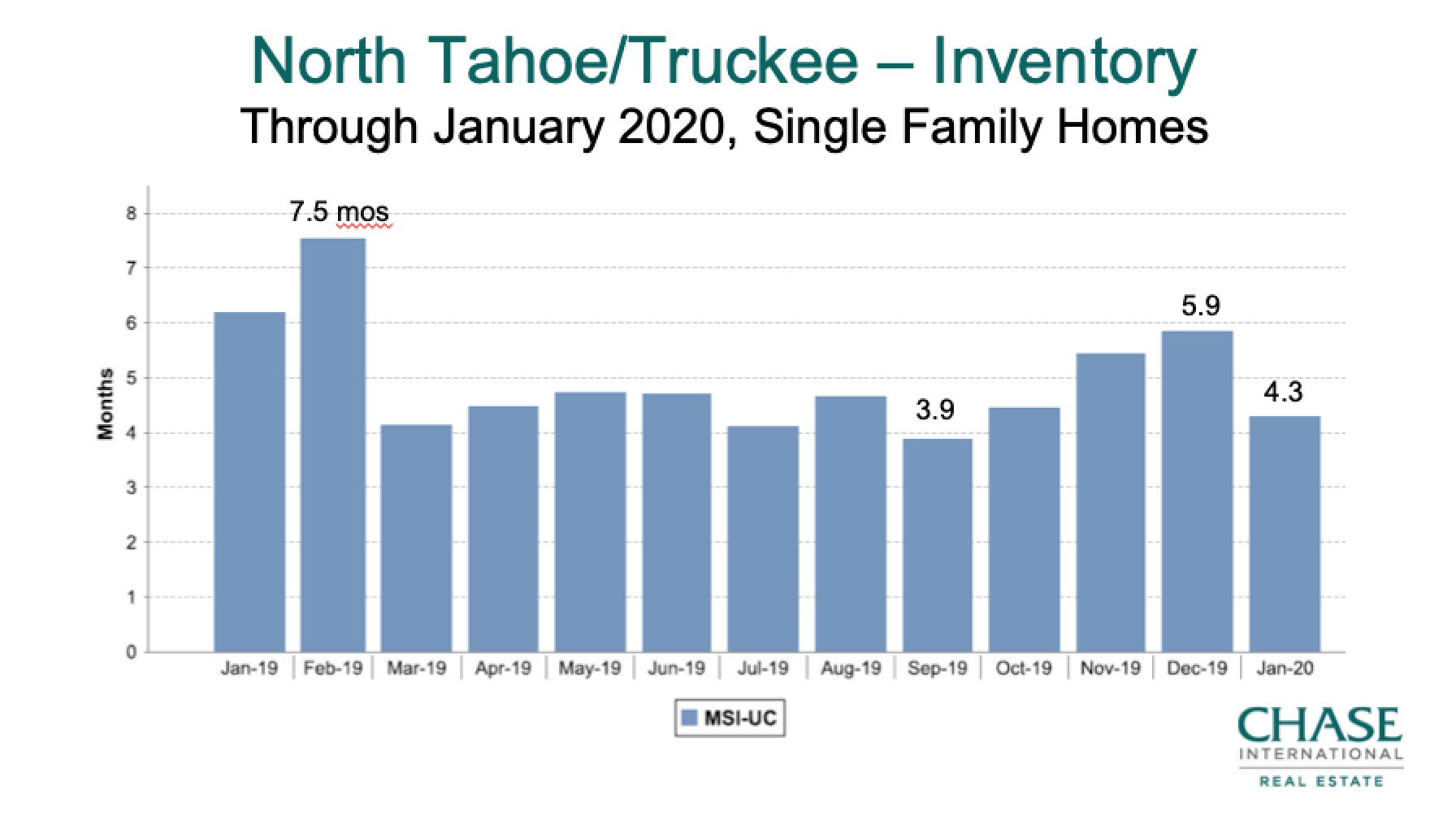

Here are some updated price and supply trend charts for areas around Lake Tahoe and Truckee from 2019 through January 2020:

[To see Lake Tahoe, Truckee and other area sales by price band, please see our 2019 Year End Real Estate Market Report.]

Inventory in Truckee and the Tahoe Basin is still low, though housing stock in the area continues to be somewhat more affordable than our primary feeder market in the Bay Area.

Generally, what happens in the San Francisco Bay area real estate market ripples out to Tahoe 12-18 months later. Given the slowdown we’re seeing there, we expect a similar dynamic to continue playing out in Tahoe-Truckee this year.

BOTTOM LINE: Prices for affordable and value-priced homes should hold steady, while the upper end may experience a bit more softening following Bay Area housing trends. The ultra high end is likely to be unaffected given the strength of the current macroeconomy. Constrained supply of inventory may drive down unit sales in 2020.